Step2:

George Soros, George Soros, the lead singer of György Schwartz (Schwartz), American Jewish businessman, prominent philanthropist, currency speculators, stock investors and political activists, on August 12, 1930 in Budapest, Hungary - born, Jewish George Soros, George Soros, the lead singer of György Schwartz (Schwartz), American Jewish businessman, prominent philanthropist, currency speculators, stock investors and political activists, on August 12, 1930 in Budapest, Hungary - born, Jewish . Soros 1997 flash hit Hong Kong's financial markets, the dollar slipped to its exchange rate, financial market turmoil Soros 1997 flash hit Hong Kong's financial markets, the dollar slipped to its exchange rate, financial market turmoil .

Hong Kong Monetary Authority stepped into the market immediately, and the central government's full support for the Hong Kong Monetary Authority stepped into the market immediately, and the central government's full support for the . in a series of retaliatory action, Soros in Hong Kong "campaign" has not been able to do so, in a series of retaliatory action, Soros in Hong Kong "campaign" has not been able to do so,.

disastrous turn of the century, through Mr. Soros's Open Society Foundations and its predecessor, "The Open Society Institute", a "color revolution" rearward Georgia's 2003 "Rose Revolution", by the end of the 2004 "Orange Revolution" in Ukraine, Turkey's parliament to amend the Constitution, the ouster of Hosni Mubarak of Egypt played an important role in improving the Georgia's 2003 "Rose Revolution", by the end of the 2004 "Orange Revolution" in Ukraine, Turkey's parliament to amend the Constitution, the ouster of Hosni Mubarak of Egypt played an important role in improving the .

have Public opinion analysis, the so - called "open society" or "assistance" is just finishing, Mr. Soros was the real intention of the world output of American ideology and values, by a change of government in the country, for their own financial speculation help to decide the future of the

Character Experience

12 August 1930, George Soros was born in Budapest, Hungary 12 August 1930, George Soros was born in Budapest, Hungary . 1944, with the Nazi invasion of Budapest, and Soros's happy childhood ended abruptly, with the family began life on the run 1944, with the Nazi invasion of Budapest, and Soros's happy childhood ended abruptly, with the family began life on the run .

It's dangerous and painful years, father of smart and strong, With a fake ID and supplied by well - wishers of the asylum, the family finally escaped the carnage of It's dangerous and painful years, father of smart and strong, With a fake ID and supplied by well - wishers of the asylum, the family finally escaped the carnage of . later said that Soros, 1944 he was in the life of the happiest moments, his death from distress to learn survival skills, two of which experiences subsequent career - speculation turns out to be useful,The first is not afraid to take risks, is the second adventure when not on the whole of later said that Soros, 1944 he was in the life of the happiest moments, his death from distress to learn survival skills, two of which experiences subsequent career - speculation turns out to be useful,The first is not afraid to take risks, is the second adventure when not on the whole of .

in 1947, with his family emigrated to the UK in 1947, with his family emigrated to the UK . 17 - year - old Mr. Soros to leave Hungary, to prepare the advanced Western countries seeking to develop

he went to the Swiss cities of Bern, and then went to London to be backing he went to the Swiss cities of Bern, and then went to London to be backing . London the wonderful vision of reality is shattered, 'It's not the poor of the world, a paradise of the rich London the wonderful vision of reality is shattered, 'It's not the poor of the world, a paradise of the rich .

But he does odd jobs to make a living, isn't any fun and fresh But he does odd jobs to make a living, isn't any fun and fresh . in 1949, in order to change your fate, in 1949, in order to change your fate,.

Soros Soros admitted to the London School of Economics elective in 1977 Nobel economics laureate John Mead (John Meade) courses, although known George Mead, Mr. Soros argues are not learnt anything he likes another liberal philosopher Karl Popper Karl Popper, Carl encouraged him to think seriously about the way the world works, and possibly from the philosophy angle, explained that he likes another liberal philosopher Karl Popper Karl Popper, Carl encouraged him to think seriously about the way the world works, and possibly from the philosophy angle, explained that .

This Soros established the financial markets of the new theory, which lays a solid foundation for the This Soros established the financial markets of the new theory, which lays a solid foundation for the . 1952, 1952,.

obtained a Bachelors Degree from the London School of Economics in 1953, entering the financial sector, gold and the like of the commodities and equities arbitrage activities obtained a Bachelors Degree from the London School of Economics in 1953, entering the financial sector, gold and the like of the commodities and equities arbitrage activities . 1956, emigrated to America, to the New York trader, buy and sell shares 1956, emigrated to America, to the New York trader, buy and sell shares .

1963, Soros started in love Hod Brecher's work for the company, which is a major manufacturer of foreign trade on U.S. companies have been hired to be an analyst for Soros, right from the beginning, he mainly engaged in foreign securities analysis Soros, right from the beginning, he mainly engaged in foreign securities analysis .

due to his European form a network of links, but he was able to speak many European languages, including French, German,Soros became a pioneer in the field of due to his European form a network of links, but he was able to speak many European languages, including French, German,Soros became a pioneer in the field of . in 1969, the investment management company and S. Bleichroeder

Double Eagle Fund, founded in 1973, who founded Soros Fund Management Double Eagle Fund, founded in 1973, who founded Soros Fund Management . 1973, Soros and Rogers Bleichroeder aides leave on your own and co - founded Soros Fund Management Company 1973, Soros and Rogers Bleichroeder aides leave on your own and co - founded Soros Fund Management Company .

functioning when there are only three people: Soros traders, Mr. Rogers is a researcher, an unnamed secretary 1975,George Soros started on Wall Street community in spectacular 1975,George Soros started on Wall Street community in spectacular .

His moneymaking prowess has been in the His moneymaking prowess has been in the . in 1979, the First Foundation - the Open Society Fund (for the Open Society Fund), with a fortune of about 2, 500 in 1979, the First Foundation - the Open Society Fund (for the Open Society Fund), with a fortune of about 2, 500 .

$in 1979, Mr. Soros decided to renamed the company the Quantum Fund, is derived from Heisenberg's quantum mechanics uncertainty law 1988, Drew Miller hired Ken manages the day - to - day transactions, manage to focus attention on the philanthropic work 1988, Drew Miller hired Ken manages the day - to - day transactions, manage to focus attention on the philanthropic work .

Soros in 1992, betting on a devaluation of the pound, $1 billion in profit Soros in 1992, betting on a devaluation of the pound, $1 billion in profit . 1997, sniping Baht and Hong Kong dollar, 1997, sniping Baht and Hong Kong dollar,.

triggered the Asian financial crisis of 1997, it entered the Russian investment triggered the Asian financial crisis of 1997, it entered the Russian investment . 2000, Ken Drew Miller in the internet bubble in hand after a loss, Mr. Soros subsequently placed more money entrusted management portfolio manager

2007 US subprime mortgage crisis accelerated deterioration, Soros also sits back to the nest, the same year the Quantum Fund in return for up to 32%, 8% in the June 2008 return, beating the overall industry average fell 19 per cent by the end of the 2007 US subprime mortgage crisis accelerated deterioration, Soros also sits back to the nest, the same year the Quantum Fund in return for up to 32%, 8% in the June 2008 return, beating the overall industry average fell 19 per cent by the end of the . In 2011, "Forbes" richest person in the world by total number 46, with a fortune of US $14.5 billion

July 27, 2011George Soros announced the end of his 40 - year career as a hedge fund manager, which is in charge of a total of $25.5 billion in fund management companies will also be made available for external investors repatriate funds refund all customer funds, and to his family refund all customer funds, and to his family .

fund in 2012, the yen, and at least $10 billion fund in 2012, the yen, and at least $10 billion . on September 22, 2013, Soros and japanese woman how beautiful son George married on September 22, 2013, Soros and japanese woman how beautiful son George married .

this torment as much attention for the debut, Mr. Soros would invoke a down tens of thousands of dollars, held for three days and the color theme of the wedding, it's the third marriage life 2015 on Jan. 22,George Soros at Davos economic forum in the ultimate retirement dinner, the family fund, Chief Investment Officer Scott Bessent, who was in charge of the

after he stopped managing investments, will make all efforts to promote philanthropy after he stopped managing investments, will make all efforts to promote philanthropy . 2017 Jan. 10, the Hungarian ruling party of Young Democrats, Vice - President of the West, Nemeth says, will be cleared by the Soros - funded NGOs

Major Kudos

Zeng obtained of the Dayton Peace Prize, was based on the 1995 Agreement aimed at ending the Bosnian civil war of the Dayton peace agreement Zeng obtained of the Dayton Peace Prize, was based on the 1995 Agreement aimed at ending the Bosnian civil war of the Dayton peace agreement . is named for the magazine "The Economist" called "broke the Bank of England's man" is named for the magazine "The Economist" called "broke the Bank of England's man" .

1992, Mr. Soros's fund up 67. 5% he have personally netted 6. 5 billion and topped the "Financial World" magazine's ranking for the revenue of the top (a record which remains)

Main Achievements

Our Portfolio

In 1960, Soros is the first foreign financial markets have experimented successfully with In 1960, Soros is the first foreign financial markets have experimented successfully with . through investigation, Soros found, due to the company's stock and real estate business rose and its stock price and the value of the assets as compared to sell at a discount, he proposed to buy Allianz shares through investigation, Soros found, due to the company's stock and real estate business rose and its stock price and the value of the assets as compared to sell at a discount, he proposed to buy Allianz shares .

Morgan Guaranty Corporation and Dreyfuss purchased large quantities of Allianz shares Morgan Guaranty Corporation and Dreyfuss purchased large quantities of Allianz shares . but others do not believe, in fact, Mr. Soros, Allianz stock tripled

. Soros rose to fame in 1973, Egypt and Syria conflict raging in Israel, because Israeli weapons behind Soros rose to fame in 1973, Egypt and Syria conflict raging in Israel, because Israeli weapons behind .

fiasco from this war,Mr. Soros reminds the US of weaponry could be out of date, the Pentagon is likely to spend huge sums of money to re - equip the army with new weapons Then Soros Fund started investing in the purchase contract with the Ministry of Defence to large amounts of stock, the Soros fund these investments for the boost in profits Then Soros Fund started investing in the purchase contract with the Ministry of Defence to large amounts of stock, the Soros fund these investments for the boost in profits .

the world's largest investors, with the "commodity play" Jim Jim Rogers, co - founder of the "Quantum Fund", had a profit of 20 billion US dollars, is referred to as" the Bank of England's defeat of the people ", Soros personal income up to 6. 8 billion,In 1992, the Wall Street topped a list of the Top Ten list believes" the jungle "investment idea of Soros, from 1968 to create" the first eagle funds", i.e., the predecessor of the Quantum Fund, to the sterling 1992 sniping is earning $2 billion, the Wall Street's Obligation to Return Deposit and Fruit At the end of 1993, boarded the "Monopoly" 's list of the 1997 Thai baht set off the Asian financial crisis snipe, due to central banks and the like, and is a major market as some of the "bad boy"

Philanthropy

Soros in the 1970s as an activist and philanthropist, he was in South Africa under the apartheid policy of funded students enrolled at the University of Cape Town, and in the direction of the iron curtain of centrifugation from providing financial assistance Soros in the 1970s as an activist and philanthropist, he was in South Africa under the apartheid policy of funded students enrolled at the University of Cape Town, and in the direction of the iron curtain of centrifugation from providing financial assistance . Soros' charities in Central and Eastern Europe and more to the society's development research group (OSI) and national Soros Fund of nominally present, sometimes in the name of the other funds, such as Poland's Stefan Foundation " Soros' charities in Central and Eastern Europe and more to the society's development research group (OSI) and national Soros Fund of nominally present, sometimes in the name of the other funds, such as Poland's Stefan Foundation ".

after the Second World War, Soros from the London School of Economics graduate, I made up my mind to become a philanthropist after the Second World War, Soros from the London School of Economics graduate, I made up my mind to become a philanthropist . From 1970s,Soros has gradually become an active philanthropist, he was in South Africa under the apartheid policy of Black students enter the University of Cape Town studying From 1970s,Soros has gradually become an active philanthropist, he was in South Africa under the apartheid policy of Black students enter the University of Cape Town studying .

since 1984, in his more than 20 countries, as well as the establishment of 35 species of since 1984, in his more than 20 countries, as well as the establishment of 35 species of . fund fund are limited mainly to finance students and provide opportunity to study abroad, to change the backward countries; secondly, the peaceful evolution, making the market more open fund fund are limited mainly to finance students and provide opportunity to study abroad, to change the backward countries; secondly, the peaceful evolution, making the market more open .

in Bill Gates and Warren Buffett started before donation, Soros donation ranked first in Bill Gates and Warren Buffett started before donation, Soros donation ranked first . Soros in an article published in the past 30 years, he has donated over $8 billion fund to promote democracy,to foster freedom of expression, improve education and the eradication of global poverty where Soros in an article published in the past 30 years, he has donated over $8 billion fund to promote democracy,to foster freedom of expression, improve education and the eradication of global poverty where .

only in 2000, the Soros Foundation's assistance in BiH for BiH in the field of education, health, social development and the like are spent nearly $500 million, to $250 million donation to the reconstruction of Bosnia - Herzegovina only in 2000, the Soros Foundation's assistance in BiH for BiH in the field of education, health, social development and the like are spent nearly $500 million, to $250 million donation to the reconstruction of Bosnia - Herzegovina . US public television network, estimates he's in 2003, a total of 40 donated $ US public television network, estimates he's in 2003, a total of 40 donated $.

2004 August, Soros donated $10 million, has launched a "were united as" of the organization, its main purpose is to want to be the next U.S. presidential election to Bush's defeat

Sniper's Hong Kong

in mid - July of 1997, HK was speculative sell - offs in the foreign exchange impact, continues to plummet, dropping to a dollar to trade at HK $7,500 near the psychological level;Hong Kong's financial markets in turmoil, banks have parked in front of, HK started for the first time in many years is a state of emergency in Hong Kong of the financial authorities to immediately enter the market, for intervention, buying up the HK dollar at HK $7.5 should be maintained above the psychological barrier of HK $7,500 made a slow start to the week, and indeed has had the effect of the made a slow start to the week, and indeed has had the effect of the .

but soon, the Port Office against the dollar it fell below 7. HK $7,500 - a - barrel threshold in the Hong Kong Monetary Authority again foreign - exchange reserves, market intervention, will pull in the foreign exchange market again risen above HK $7500,show of financial strength for the first time Soros foreign - exchange reserves, market intervention, will pull in the foreign exchange market again risen above HK $7500,show of financial strength for the first time Soros .

probing attacks in the HKMA's powerful defense in time of failure probing attacks in the HKMA's powerful defense in time of failure . Soros have just finished a beautiful "mod, which is going to sweep the entire Southeast Asian financial markets, the shot even affected the entire world of financial markets, Soros is the kind of guy but never give up easily, he started the Hong Kong dollar and there are a number of long - term buying, ready to repeat its glory in Southeast Asia and England during the Battle of Soros have just finished a beautiful "mod, which is going to sweep the entire Southeast Asian financial markets, the shot even affected the entire world of financial markets, Soros is the kind of guy but never give up easily, he started the Hong Kong dollar and there are a number of long - term buying, ready to repeat its glory in Southeast Asia and England during the Battle of .

But Soros may not wise, because he probably forgot to think about Hong Kong's behind the Chinese mainland,Hong Kong and mainland China's foreign reserve of 2000 billion, plus the Taiwan and Macao, many foreign - exchange reserves to $3740, so powerful, not England, Thailand and other countries for which comparable But Soros may not wise, because he probably forgot to think about Hong Kong's behind the Chinese mainland,Hong Kong and mainland China's foreign reserve of 2000 billion, plus the Taiwan and Macao, many foreign - exchange reserves to $3740, so powerful, not England, Thailand and other countries for which comparable . HK this attack, the odds are not HK this attack, the odds are not .

for Hong Kong fixed exchange is to maintain the confidence of the people is guaranteed, once the fixed one, Soros, etc., led the attack of international flowing capital next fall, people will lose confidence in Hong Kong, then undermining Hong Kong's prosperity, so,Hong Kong is a stable currency is doomed to a deadly clash with Hong Kong's government will do what is necessary in order to counter the value of any challenge Hong Kong's government will do what is necessary in order to counter the value of any challenge .

on 21 July 1997, Mr. Soros began a new assault on the day, the dollar was at HK $250 month premium, of $3 - month interbank - lending rate from 5 per cent to 575 7. 06% The Hong Kong Monetary Authority (HKMA) immediately to the north had performed an elaborate Strikes Back The Hong Kong Monetary Authority (HKMA) immediately to the north had performed an elaborate Strikes Back .

Hong Kong through the issuance of large sums of government bonds, raising the interest rate, in turn, leads to the dollar and the dollar rallied sharply at the same time Hong Kong through the issuance of large sums of government bonds, raising the interest rate, in turn, leads to the dollar and the dollar rallied sharply at the same time .,Both are suspected of being involved in speculation on the Hong Kong Monetary Authority, 17 Tseuk Luk Street gave an oral warning, causing some jittery speculators HK, HK $speculation last opt - out team, which undoubtedly would weaken the Soros speculation Strength ,Both are suspected of being involved in speculation on the Hong Kong Monetary Authority, 17 Tseuk Luk Street gave an oral warning, causing some jittery speculators HK, HK $speculation last opt - out team, which undoubtedly would weaken the Soros speculation Strength .

HK started to occur when the speculative sell - offs, the Hong Kong Monetary Authority and any significant increase, so that the inter - bank overnight lending rates in Hong Kong's Hang Seng index surged HK started to occur when the speculative sell - offs, the Hong Kong Monetary Authority and any significant increase, so that the inter - bank overnight lending rates in Hong Kong's Hang Seng index surged . Next 16673 from falling all the way to the point of peak 6660 points, falling by 60 percent, Mr. Soros in advance in a large enough size, HSI were interested in Please

rational judgment.

Social Assessment

Mr. Soros once said of himself: "I don't think I'm a businessman, I invest other people for your business, that's why I'm a real critic, in a way you can say I was the world's highest - paid critic This is Soros, that people can never anticipate his next step in what is, is to uplift the banner of peace, or once again shocked the world, the people were suffering as a result of the earthquake, but nonetheless, he both our world is one of the most celebrated investors of This is Soros, that people can never anticipate his next step in what is, is to uplift the banner of peace, or once again shocked the world, the people were suffering as a result of the earthquake, but nonetheless, he both our world is one of the most celebrated investors of .

Peng Xin (evaluation) often accused Soros of hypocrisy, he kept drumming at the left - wing views and even socialist ideas, and over the years,He accused the government of the United States is one of the major critics Peng Xin (evaluation) often accused Soros of hypocrisy, he kept drumming at the left - wing views and even socialist ideas, and over the years,He accused the government of the United States is one of the major critics . however, his actions should be attributed to their own economic interests, he adopted a controversial means and insider knowledge, make oneself become the billionaire's windfall however, his actions should be attributed to their own economic interests, he adopted a controversial means and insider knowledge, make oneself become the billionaire's windfall .

his modus operandi is to capture left - wing politicians, and then use their own service his modus operandi is to capture left - wing politicians, and then use their own service . 2 2.

Investment Career

Investment in the unstable state of the market is not stable state refers to when market participants anticipated that mate with the deviation between the extreme state is reached, the reaction force of the market in the self - propelled, to a certain degree, it is difficult to maintain and self - correction, so that the unbalanced development of the market to a considerable extent, if any action is uncertain state of the market imbalance of market Investment in the unstable state of the market is not stable state refers to when market participants anticipated that mate with the deviation between the extreme state is reached, the reaction force of the market in the self - propelled, to a certain degree, it is difficult to maintain and self - correction, so that the unbalanced development of the market to a considerable extent, if any action is uncertain state of the market imbalance of market . state expected by the market, the mainstream form of bias by a history; in contrast, in the market as investors began to sober introspection on the omitted variable bias, mainstream bias to challenge the dominant factors of the original becomes fragile,But the inertia of the market to enable the existing trend of fanatical state expected by the market, the mainstream form of bias by a history; in contrast, in the market as investors began to sober introspection on the omitted variable bias, mainstream bias to challenge the dominant factors of the original becomes fragile,But the inertia of the market to enable the existing trend of fanatical .

declined since reaching an extreme, Soros's investment success in discovering the unstable market and the state, capture - and - downs of the timing of occurrence of the phenomenon of declined since reaching an extreme, Soros's investment success in discovering the unstable market and the state, capture - and - downs of the timing of occurrence of the phenomenon of . For example, in a case of the mid - 1980s, the company bid for the assets of the company's bid to be re - evaluated, whereupon the other bidders, the company has enabled them to bid ever higher For example, in a case of the mid - 1980s, the company bid for the assets of the company's bid to be re - evaluated, whereupon the other bidders, the company has enabled them to bid ever higher .

finally, bidding price rise, the market value is overvalued while teetering finally, bidding price rise, the market value is overvalued while teetering . according to Soros's theory, the collapse will inevitably occur according to Soros's theory, the collapse will inevitably occur .

the ups and downs of a probable riseunstable state of the market and to provide opportunities for investers the ups and downs of a probable riseunstable state of the market and to provide opportunities for investers . in our side also has its downs, close to 1,000 US soybean when the market will be up to 1400, 1600, the bull arrived late to the development of the prices that people expected, it is a boast that doesn't want the top of the market's psychology, soy stocks is grossly underestimated, soyabeans, the imaginary component value are greatly exaggerate for in our side also has its downs, close to 1,000 US soybean when the market will be up to 1400, 1600, the bull arrived late to the development of the prices that people expected, it is a boast that doesn't want the top of the market's psychology, soy stocks is grossly underestimated, soyabeans, the imaginary component value are greatly exaggerate for .

final bust phenomenon occurs, soyabean prices plummeted, domestic importers have defaulted on expensive imported soybean fat enterprise reshuffle final bust phenomenon occurs, soyabean prices plummeted, domestic importers have defaulted on expensive imported soybean fat enterprise reshuffle . grasp - and - downs of its timing is also very critical, because the markets are often strongly biased towards the mainstream,lethality are relatively strong, only if the appropriate investment strategy, with plans to build a warehouse, to make the most of this unstable market condition sets us on grasp - and - downs of its timing is also very critical, because the markets are often strongly biased towards the mainstream,lethality are relatively strong, only if the appropriate investment strategy, with plans to build a warehouse, to make the most of this unstable market condition sets us on .

breakthrough investment opportunities is a distorted idea of Soros is a masterclass in financial theorist, he is always static, if stops the water, be calm, not indulge in maniacal laughter, frown, he owned from its involvement with the game's unique approach, which has the understanding of financial markets, which is necessary for the particular style, with unique market insight capabilities of the breakthrough investment opportunities is a distorted idea of Soros is a masterclass in financial theorist, he is always static, if stops the water, be calm, not indulge in maniacal laughter, frown, he owned from its involvement with the game's unique approach, which has the understanding of financial markets, which is necessary for the particular style, with unique market insight capabilities of the . to the secret of success is his philosophical to the secret of success is his philosophical .

all of you, and he wanted to be a philosopher,attempts to solve one of the most basic human proposition there all of you, and he wanted to be a philosopher,attempts to solve one of the most basic human proposition there . however he quickly reached a dramatic conclusion, the life of the mysterious realm of possibility that almost does not exist, because, first of all, the people must be able to take an objective view of itself, but the problem with this, it is not possible, however he quickly reached a dramatic conclusion, the life of the mysterious realm of possibility that almost does not exist, because, first of all, the people must be able to take an objective view of itself, but the problem with this, it is not possible, .

he drew the conclusion that people are considering objects, cannot get rid of the fetter and the point of view, so,thought process in which it is not possible to obtain independent viewpoint to provide a judgment evidence or, on the other hand, there is given neither understand he drew the conclusion that people are considering objects, cannot get rid of the fetter and the point of view, so,thought process in which it is not possible to obtain independent viewpoint to provide a judgment evidence or, on the other hand, there is given neither understand . this conclusion on his philosophy lives on through his observation on the financial market has had a profound impact on this conclusion on his philosophy lives on through his observation on the financial market has had a profound impact on .

cannot conclude that the independent views of the result, people are unable to penetrate the fur of discretion, an impartial arrived cannot conclude that the independent views of the result, people are unable to penetrate the fur of discretion, an impartial arrived . truth is to say, the absolute perfection of knowability is rather doubtful truth is to say, the absolute perfection of knowability is rather doubtful .

as Soros puts it, when anyone tries to explore his environment, he never attained the recognition of known as Soros puts it, when anyone tries to explore his environment, he never attained the recognition of known . Soros as deduced from such a logic: because human beings know there is a defect,So he can do the most practical thing is necessary to pay attention to all of the entities and the distorted perception of it - - it's logical and later formed his financial strategy of non - core Soros as deduced from such a logic: because human beings know there is a defect,So he can do the most practical thing is necessary to pay attention to all of the entities and the distorted perception of it - - it's logical and later formed his financial strategy of non - core .

people God, for not understanding of how markets should be a normal phenomenon, however when the vast majority of investors in the market fundamentals of a consensus, and there is continued speculation, this perception is also at risk of edge people God, for not understanding of how markets should be a normal phenomenon, however when the vast majority of investors in the market fundamentals of a consensus, and there is continued speculation, this perception is also at risk of edge . market themselves in failure of the fifth wave after wave, and a fifth extension would occur in the V - shaped ", with George Soros's view of philosophy, we can easily find out the answer market themselves in failure of the fifth wave after wave, and a fifth extension would occur in the V - shaped ", with George Soros's view of philosophy, we can easily find out the answer .

in this,Despite the obstacles of philosophic commentary on Mr. Soros, a successful investor should first solve the problem, in that his worldview and methodology, which will make its station at a higher angle, in a broader view, the dialectic method of thinking is going on the market, always be sober - minded, in that, in their stride and they eventually succeed other perspectives and theoretical investment strategy: to "reflective" and the "ups and downs theory", on the basis of the theory of market transition in and out, using the "herd effect"inverse in the active market manipulators and market speculation is other perspectives and theoretical investment strategy: to "reflective" and the "ups and downs theory", on the basis of the theory of market transition in and out, using the "herd effect"inverse in the active market manipulators and market speculation is .

. in the light of trends in the sheep - flock effect "is that people are often the most affected, whereas the following public thoughts or behavior, also referred to as the" bandwagon effect " in the light of trends in the sheep - flock effect "is that people are often the most affected, whereas the following public thoughts or behavior, also referred to as the" bandwagon effect ".

people tend to follow the Volkswagen agreed, doesn't go thinking that the significance of the event people tend to follow the Volkswagen agreed, doesn't go thinking that the significance of the event . herd effect is an appeal to the masses of the fallacies in economics - based herd effect is an appeal to the masses of the fallacies in economics - based .

often use" flock effect "to describe economic individual herd sheep follow suit psychological.Have is a kind of organization is messy, together also - - blind elbowed right and left, but once there is a sheep, the other of the sheep they jump on the bandwagon,in open defiance of the front of the wolf might have or just have a better grass is a kind of organization is messy, together also - - blind elbowed right and left, but once there is a sheep, the other of the sheep they jump on the bandwagon,in open defiance of the front of the wolf might have or just have a better grass .

Therefore, "flock effect" is a metaphor for all human beings have a kind of conformity, conformity and can easily lead to conformism, conformism will often fall into the scam or fail Therefore, "flock effect" is a metaphor for all human beings have a kind of conformity, conformity and can easily lead to conformism, conformism will often fall into the scam or fail . theory elaborates: Soros's investment is the core theory of "reflexivity" is simply one means the markets between investors and one of the interactive influence of theory elaborates: Soros's investment is the core theory of "reflexivity" is simply one means the markets between investors and one of the interactive influence of .

people understand the world and on the theory that it is not possible, the investors are holding "Prejudice" to enter the market, while the prejudice is to know the financial power of the key when people understand the world and on the theory that it is not possible, the investors are holding "Prejudice" to enter the market, while the prejudice is to know the financial power of the key when . "popular prejudice" is only a niche player, the influence is still very small,But different investors of prejudice in the interactive groups influence, will become dominant with "popular prejudice" is only a niche player, the influence is still very small,But different investors of prejudice in the interactive groups influence, will become dominant with .

concept is the "herd effect" concept is the "herd effect" . ways in "big plays" of the market in the huge capital lured investors are collectively crazy purchasing, thus further boost the market price, until the price falls crazy in ways in "big plays" of the market in the huge capital lured investors are collectively crazy purchasing, thus further boost the market price, until the price falls crazy in .

market will crumble, and take the lead in spearheading the sell - off, based on the market has been at the pinnacle, fragile and vulnerable, so any changes can be attributed to panic sell - off, with further decline until the crash market will crumble, and take the lead in spearheading the sell - off, based on the market has been at the pinnacle, fragile and vulnerable, so any changes can be attributed to panic sell - off, with further decline until the crash . in the ups and downs of the speculative price in the ups and downs of the speculative price .

Altum earn out, the rules and taboos:There is no strict principles or rules, the only intuitively and offensive strategies is performed at a stroke of winning "the law of the jungle" Altum earn out, the rules and taboos:There is no strict principles or rules, the only intuitively and offensive strategies is performed at a stroke of winning "the law of the jungle" . jungle i.e.: 1, a wait occurs;2, weak attack;3, to be ruthless when on the offensive, and it is for the best; and4, if something does not surprise, life is first considered

the overall situation and individual shares the views of the relationship: a market - oriented atmosphere, value trend lightly the overall situation and individual shares the views of the relationship: a market - oriented atmosphere, value trend lightly . think stocks market in short term is simply a "flock effect", with stocks that are not related to the quality of forecasting stock market views on think stocks market in short term is simply a "flock effect", with stocks that are not related to the quality of forecasting stock market views on .

: : . does not predict the market opportunity is near, the initiative to guide the market does not predict the market opportunity is near, the initiative to guide the market .

investment tool that there was little specific investment styles, not in accordance with established principles of investment tool that there was little specific investment styles, not in accordance with established principles of . but mindful of the change in the rules of the game but mindful of the change in the rules of the game .

"hedge fund" this cycle of mortgage lending in the way to the amplification lever, this lever, just need to find the right point,It even can prize the whole monetary system international "hedge fund" this cycle of mortgage lending in the way to the amplification lever, this lever, just need to find the right point,It even can prize the whole monetary system international . quotes and ideas: "fry like an animal in the world of the law of the jungle, special attack the weak, often serving with quotes and ideas: "fry like an animal in the world of the law of the jungle, special attack the weak, often serving with .

" "everyone has a weakness, likewise, any economic system there are also weaknesses, it is often the most indestructible little " "everyone has a weakness, likewise, any economic system there are also weaknesses, it is often the most indestructible little .", herd behavior is the key to the success of the venture, if this effect is non - existent or very weak, almost certainly we can hardly be successful ", herd behavior is the key to the success of the venture, if this effect is non - existent or very weak, almost certainly we can hardly be successful .

"and other achievements: In 1930, a Hungarian - born, Jewish, and in 1968 founded the" first eagle funds",1993 year Wall Street tycoons topped the Hot 100, 1992 all earn 20 billion pound snipe, snipe the baht in 1997, the Asian financial turmoil "and other achievements: In 1930, a Hungarian - born, Jewish, and in 1968 founded the" first eagle funds",1993 year Wall Street tycoons topped the Hot 100, 1992 all earn 20 billion pound snipe, snipe the baht in 1997, the Asian financial turmoil .

Inspiration Of Investment

Past experience suggests that people, who can neither hear nor hear the newsletters and the economy of the home, but wanted to see the "god of stocks, investment gurus and richest man in what has become of the money Past experience suggests that people, who can neither hear nor hear the newsletters and the economy of the home, but wanted to see the "god of stocks, investment gurus and richest man in what has become of the money . because only they are real money, not the because only they are real money, not the .

navel - gazing and at the same time, the N secondary investment practices have proved they are still the next wave bull market leader navel - gazing and at the same time, the N secondary investment practices have proved they are still the next wave bull market leader . Soros said the financial markets are inherently unstable, particularly in international financial markets, international capital flows all have a Rong has withered, had been known to also have short Soros said the financial markets are inherently unstable, particularly in international financial markets, international capital flows all have a Rong has withered, had been known to also have short .

market where chaos; there is money to be made to identify market where chaos; there is money to be made to identify . chaos, you just might get rich;The chaos, the more cautious investors behave when chaos, you just might get rich;The chaos, the more cautious investors behave when .

Soros regardless of money, losing money, and all of its consequences is' in his life, money is not so important, the money is his work, not his destination Soros regardless of money, losing money, and all of its consequences is' in his life, money is not so important, the money is his work, not his destination . such accomplishments deserve investors' efforts to cultivate learning with such accomplishments deserve investors' efforts to cultivate learning with .

Classical Sayings

1. The market is always wrong 2 It's not important to your judgment is wrong or right, but you are right to be the most out of your power!3, "I am penniless, but never to die while they are poor and 2 It's not important to your judgment is wrong or right, but you are right to be the most out of your power!3, "I am penniless, but never to die while they are poor and .

" hanging on the wall in the office of " hanging on the wall in the office of . 4, If you're so good, then, the first step you want to cut spending, but don't recover funds 4, If you're so good, then, the first step you want to cut spending, but don't recover funds .

when you back into it, following the start of a number of smaller when you back into it, following the start of a number of smaller . 5, do not know what will happen next is not terrible, frightening thing is that she doesn't know if what they do in 5, do not know what will happen next is not terrible, frightening thing is that she doesn't know if what they do in .

6 that want to succeed, there must be plenty of free time 6 that want to succeed, there must be plenty of free time . 7, on the stock market and seek forgiveness not present in this mutant 7, on the stock market and seek forgiveness not present in this mutant .

8, stocks typically are untrustworthy, therefore,If the Wall Street area between you and others who follow the fashion, then, your stock business doomed is grim and 8, stocks typically are untrustworthy, therefore,If the Wall Street area between you and others who follow the fashion, then, your stock business doomed is grim and . 9, are in the market, you would be prepared to endure pain and 9, are in the market, you would be prepared to endure pain and .

10, If your investments performed well, then, and let nature takes its course, and all your assets into it 10, If your investments performed well, then, and let nature takes its course, and all your assets into it . 11 and people thought I won't make a mistake, it is a completely misunderstood 11 and people thought I won't make a mistake, it is a completely misunderstood .

And I say, about anything I and other offenders in such a way that the same wrong And I say, about anything I and other offenders in such a way that the same wrong . But my Superman that I was able to realize his mistakes. "That's the secret of success

. My insight is that a human mind to recognize the inherent wrong My insight is that a human mind to recognize the inherent wrong .

12,I'm not willing to spend a lot of time and the stock market and the people together, I think they hated, and intellectuals together than businessmen together and feel much more comfortable and 12,I'm not willing to spend a lot of time and the stock market and the people together, I think they hated, and intellectuals together than businessmen together and feel much more comfortable and . 13, for years I denied it (investment) as my profession it is 13, for years I denied it (investment) as my profession it is .

means means . I'm willing to accept as a matter of fact, this is a life - long career I'm willing to accept as a matter of fact, this is a life - long career .

14, I have been with the company and 14, I have been with the company and . it to me, and I also live it in together, inseparable by day and by night it's my lover. I am afraid of losing it

also worry about failure, and avoid mistakes also worry about failure, and avoid mistakes . This is a tragic life This is a tragic life .

15, I was completely absorbed by this work,But this is indeed a very painful experience 15, I was completely absorbed by this work,But this is indeed a very painful experience . aspect, whenever I am in the market if make the wrong decision, I had to endure tremendous mental torture aspect, whenever I am in the market if make the wrong decision, I had to endure tremendous mental torture .

on the other hand, I really don't want to be successful while making lots of money as a necessary means of on the other hand, I really don't want to be successful while making lots of money as a necessary means of . To find I'm making a financial decision - making rules, I deny I have successfully To find I'm making a financial decision - making rules, I deny I have successfully .

16, world economic history is based on a lie and the illusion of drama 16, world economic history is based on a lie and the illusion of drama . gain wealth, it is the pinnacle of illusion, to get into it, then illusion is public awareness gain wealth, it is the pinnacle of illusion, to get into it, then illusion is public awareness .

17 exits before the game, I think I'm not a businessman, I invest other people for your business,So I'm a real critic, in a way you can call me The world's best paid critic 17 exits before the game, I think I'm not a businessman, I invest other people for your business,So I'm a real critic, in a way you can call me The world's best paid critic . 18, human cognition and incomplete, and thus to influence the integrity of the thing itself, popular perceptions to the contrary to the prejudices prevailing and dominant 18, human cognition and incomplete, and thus to influence the integrity of the thing itself, popular perceptions to the contrary to the prejudices prevailing and dominant .

trends reinforce each other, until the distance therebetween is so large as to cause non - catastrophe, it's something you should take special precautions, and it is only then possible in a boom - bust phenomenon trends reinforce each other, until the distance therebetween is so large as to cause non - catastrophe, it's something you should take special precautions, and it is only then possible in a boom - bust phenomenon . 19, I have to change the way people think of me, because I didn't want to just a wealthy man, I got something to say, I think I heard the sound of 19, I have to change the way people think of me, because I didn't want to just a wealthy man, I got something to say, I think I heard the sound of .

20,In the world of finance is a turbulent, chaotic, disordered triable only discern the illogic. , , .

can we cinch a victory if financial market movements as part of a mathematical formula, but would never work can we cinch a victory if financial market movements as part of a mathematical formula, but would never work . mathematics cannot control the financial markets, while the psychological factors is the key to control market mathematics cannot control the financial markets, while the psychological factors is the key to control market .

more precisely, to adhere to only the instinct of the masses in order to control the market, i.e. must understand when and how ownership would be in a kind of stock, commodity or currency around, investors are likely to succeed.

Personal Life

George Soros was born in Budapest, Hungary to a wealthy jewish family until 1946, all living in Hungary George Soros was born in Budapest, Hungary to a wealthy jewish family until 1946, all living in Hungary . father was a lawyer, a tough, street - smart, but he is weak on Soros profoundly influence the father was a lawyer, a tough, street - smart, but he is weak on Soros profoundly influence the .

not only taught Soros to be self - confident, strong, and from the education the Soros, a peaceful attitude toward wealth, Soros later in life, the practice was also father of the mind ", a life to philanthropy in not only taught Soros to be self - confident, strong, and from the education the Soros, a peaceful attitude toward wealth, Soros later in life, the practice was also father of the mind ", a life to philanthropy in . 1949, once, almost makes Soros dropped out of poverty,But at the London School of Economics of wisdom to help combat loneliness Soros 1949, once, almost makes Soros dropped out of poverty,But at the London School of Economics of wisdom to help combat loneliness Soros .

let him in the books and ideas found in the greatest fun, he also wrote a book, but never finished it, they should step in, because it's almost graduation, the young Soros how many fantasies about the future, must be a living let him in the books and ideas found in the greatest fun, he also wrote a book, but never finished it, they should step in, because it's almost graduation, the young Soros how many fantasies about the future, must be a living . 1953, Soros graduated from the London School of Economics, but this degree him no help 1953, Soros graduated from the London School of Economics, but this degree him no help .

him to do everything that I could find work, first of all go to the North of England, the seaside resort of handbag sales, but this experience made him feel life is hard and difficult, especially for people of the importance of him to do everything that I could find work, first of all go to the North of England, the seaside resort of handbag sales, but this experience made him feel life is hard and difficult, especially for people of the importance of . start he gradually abandoned the old - time - in - the - sky,seek one capable of providing high - wage job start he gradually abandoned the old - time - in - the - sky,seek one capable of providing high - wage job .

London investment banks to enter the portals of the city's investment bank to each write a letter to apply for, finally, the opportunity, Xin spent much of his career with Fred Rand provided a trainee's work, Mr. Soros can finally get rid of the long - standing poverty, have had a menial job, but his financial career prelude the Soros obsessing about this work, became a gold equities arbitrage is very specialized and traders, especially in using the different money market post Soros obsessing about this work, became a gold equities arbitrage is very specialized and traders, especially in using the different money market post .

subject matter expertise that he began to have some money,But London monotonic cannot meet the growing up of Soros, decided he had to the world's largest financial centre, a paradise for the adventurers in New York for an adventure!and other wealthy individuals, compared to his private life was austere, with billions of dollars to treat philanthropy subject matter expertise that he began to have some money,But London monotonic cannot meet the growing up of Soros, decided he had to the world's largest financial centre, a paradise for the adventurers in New York for an adventure!and other wealthy individuals, compared to his private life was austere, with billions of dollars to treat philanthropy . on September 22, 2013, the 83 - year - old billionaire, had a "financial giant" tycoon George Soros in New York in the vicinity of a luxurious manor married his 42 - year - old bride, This is his third marriage on September 22, 2013, the 83 - year - old billionaire, had a "financial giant" tycoon George Soros in New York in the vicinity of a luxurious manor married his 42 - year - old bride, This is his third marriage .

Viewpoint

Europe's debt crisis - related big investment views to George Soros said on Tuesday, the euro - zone bonds only to EU countries from the European debt crisis rescue Europe's debt crisis - related big investment views to George Soros said on Tuesday, the euro - zone bonds only to EU countries from the European debt crisis rescue . He also criticized Germany's government debt crisis in the role, said Germany needs to accept the European debt crisis, you should exit the euro He also criticized Germany's government debt crisis in the role, said Germany needs to accept the European debt crisis, you should exit the euro .

Soros believes that this has led the European hand - wringing in the EU crisis is entirely self - inflicted, the euro really could ruin the EU Soros believes that this has led the European hand - wringing in the EU crisis is entirely self - inflicted, the euro really could ruin the EU . he added: "The escape of the German method is better for domestic and other debtor countries responsible for interest rates, to save the euro and the euro bond plan he added: "The escape of the German method is better for domestic and other debtor countries responsible for interest rates, to save the euro and the euro bond plan .

if successful, the cost will be small, but if that fails,Germany is likely to bring down the entire economy of if successful, the cost will be small, but if that fails,Germany is likely to bring down the entire economy of . "euro bonds, risks in the eurozone is one way to "euro bonds, risks in the eurozone is one way to .

another solution to the crisis is for Germany to leave the euro and the International Monetary Fund another solution to the crisis is for Germany to leave the euro and the International Monetary Fund . some other finance ministers are to press the Germans, forcing it to take measures to resolve the crisis in the eurozone to Germany is some other finance ministers are to press the Germans, forcing it to take measures to resolve the crisis in the eurozone to Germany is .

the front of a northern euro zone creditor and debtors in the debt - laden southern euro - zone's future and a huge conflict of opinion the front of a northern euro zone creditor and debtors in the debt - laden southern euro - zone's future and a huge conflict of opinion . German says,said Greece needed more time to achieve the deficit target down - regulation of premature German says,said Greece needed more time to achieve the deficit target down - regulation of premature .

these small countries might still end up exiting the euro these small countries might still end up exiting the euro . helter - skelter in the key of the problem of Spain will apply for financial assistance from the eurozone, and Greece's agreed to new austerity measures helter - skelter in the key of the problem of Spain will apply for financial assistance from the eurozone, and Greece's agreed to new austerity measures .

Germany, Finland and the Netherlands the publics opposition to the government of other euro - zone countries to accept bailouts Germany, Finland and the Netherlands the publics opposition to the government of other euro - zone countries to accept bailouts . Soros said the euro - zone economies, riskless government theory is one of the assumptions, it can be the introduction of the euro debt but politically correct Soros said the euro - zone economies, riskless government theory is one of the assumptions, it can be the introduction of the euro debt but politically correct .

Germany would not accept the way Germany would not accept the way . manipulation theory in Soros' eyes, the pursuit of philosophy is the human pursuit of wisdom ' manipulation theory in Soros' eyes, the pursuit of philosophy is the human pursuit of wisdom '.

1',What is the reflexive?investor George Soros's reflexivity is a philosophical concept proposed by 1',What is the reflexive?investor George Soros's reflexivity is a philosophical concept proposed by . Soros in college, which is now in its mentor Karl Popper falsifiable and philosophy, and on this basis the principle of reflexivity, while the application of this principle to his securities practice, to thereby obtain the huge success of Soros in college, which is now in its mentor Karl Popper falsifiable and philosophy, and on this basis the principle of reflexivity, while the application of this principle to his securities practice, to thereby obtain the huge success of .

Popper philosophy of perjury on his major inspiration indicates the human cognitive activities of nature's Popper philosophy of perjury on his major inspiration indicates the human cognitive activities of nature's . people constantly in only one criticism of the process is close to the truth, in the process of all judges were only temporary and effective,Falsification of people constantly in only one criticism of the process is close to the truth, in the process of all judges were only temporary and effective,Falsification of .

and all objects in the stock market needs to be understood accordingly: for pristine and innocent, scientific definition, quantization method judge the future trend of the stock, investors will make a one mistake and all objects in the stock market needs to be understood accordingly: for pristine and innocent, scientific definition, quantization method judge the future trend of the stock, investors will make a one mistake . because we cannot ignore the unfolding before us K line behind someone's idea and spirituality at work, such as the small investor of buying motives and desires, professional investors and investment expected investment behavior, the guys do the stock market, intentionally, lifting, etc because we cannot ignore the unfolding before us K line behind someone's idea and spirituality at work, such as the small investor of buying motives and desires, professional investors and investment expected investment behavior, the guys do the stock market, intentionally, lifting, etc .

the existing stock of various technical indicators (quantitative), morphological (such as M - head, Head and Shoulders Bottom,Duck Head etc) analysis theory and analysis tool, a participant in the investment of conscious and have thoughts, meditated, and has a specific purpose of the transaction that is pocket change, of a no - win the existing stock of various technical indicators (quantitative), morphological (such as M - head, Head and Shoulders Bottom,Duck Head etc) analysis theory and analysis tool, a participant in the investment of conscious and have thoughts, meditated, and has a specific purpose of the transaction that is pocket change, of a no - win . is based on the philosophy, Soros of investors in the 25 - year career, she has developed a unique investment idea: the theory of reflexivity is based on the philosophy, Soros of investors in the 25 - year career, she has developed a unique investment idea: the theory of reflexivity .

so - called reflexivity, it indicates that the participant's thought and that they are participating in the events are not full independence, not only the interaction therebetween, and a mutual decision, there is no corresponding symmetric or so - called reflexivity, it indicates that the participant's thought and that they are participating in the events are not full independence, not only the interaction therebetween, and a mutual decision, there is no corresponding symmetric or ., for example, the investing public enthusiasm and participation behavior will naturally affect the share price rise,and when the rise of the idea after being formed, which in turn will act on its price, but not necessarily to form the public awareness of developments, often disappointing the deviation which occurs as a result of the Evolution , for example, the investing public enthusiasm and participation behavior will naturally affect the share price rise,and when the rise of the idea after being formed, which in turn will act on its price, but not necessarily to form the public awareness of developments, often disappointing the deviation which occurs as a result of the Evolution .

the investing public pessimism when exiting, the stock price back to life with unexpected surge in volatility the investing public pessimism when exiting, the stock price back to life with unexpected surge in volatility . Soros pointed out that the market is always right, our analysis tools exist that cannot be accurately predicted by the position coordinates and Soros pointed out that the market is always right, our analysis tools exist that cannot be accurately predicted by the position coordinates and .

because market participants anticipate deviation, such deviation will be influenced by the trading activities of the process, is not expected in the future with the facts, but about the future of the event by anticipating a because market participants anticipate deviation, such deviation will be influenced by the trading activities of the process, is not expected in the future with the facts, but about the future of the event by anticipating a . shape the market is not balanced, the participants and the event itself is not independent,participants to the decision taken by the entire event itself might also affect shape the market is not balanced, the participants and the event itself is not independent,participants to the decision taken by the entire event itself might also affect .

i.e. participants will also affect the event, the event is a dynamic fluctuation in Soros's investment philosophy is built on "the theory of reflexivity", and on the basis of its theory meaning is: It is assumed that human behavior is y, the knowledge of people is x, due to the action of a certain person is a person of great awareness of the right and left, therefore, the behavior is a function expressed as: y = f (x) as meaning that it is: what kind of knowledge is what Soros's investment philosophy is built on "the theory of reflexivity", and on the basis of its theory meaning is: It is assumed that human behavior is y, the knowledge of people is x, due to the action of a certain person is a person of great awareness of the right and left, therefore, the behavior is a function expressed as: y = f (x) as meaning that it is: what kind of knowledge is what .

the same behavior, people did not appear in isolation, the knowledge of people is affected by the influence of objective world,And the objective world in turn is closely related with people's behavior of the same behavior, people did not appear in isolation, the knowledge of people is affected by the influence of objective world,And the objective world in turn is closely related with people's behavior of . means a person's actions are counter - productive to the people's cognition, cognition is the behavior of the function expressed as: x = F (y) as meaning that it is: there's some kind of behavior, a sort of knowledge the means a person's actions are counter - productive to the people's cognition, cognition is the behavior of the function expressed as: x = F (y) as meaning that it is: there's some kind of behavior, a sort of knowledge the .

above two equations, we can obtain such a formula: y = f (y) F (x) = F (f (x) that is to say, the x and y is itself a function of the change knowledge is the understanding of the changes of function, behavior is a behavior change as a function of the above two equations, we can obtain such a formula: y = f (y) F (x) = F (f (x) that is to say, the x and y is itself a function of the change knowledge is the understanding of the changes of function, behavior is a behavior change as a function of the . Soros uses this function mode is referred to as" reflexivity " Soros uses this function mode is referred to as" reflexivity ".

it is in fact a" autoregressive system " it is in fact a" autoregressive system ". 2.Theory of reflexivity model Mr Soros said: "The market has a large number of participants, their opinions must be made, many of which deflection cancel each other, and the rest is my so - called mainstream bias'

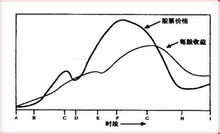

" "there's something that's reflexive sexual relationship, in which the stock price depends on two factors - - - - the basic trend of the mainstream and biased - - - - both came again under the affects of " "there's something that's reflexive sexual relationship, in which the stock price depends on two factors - - - - the basic trend of the mainstream and biased - - - - both came again under the affects of .", as is shown in the figure, as Soros's chart, we can see the statement of the basic trend.means the shares of the company's per - share earnings of

currently stock while the participant's per - share earnings trend deviations cancel each other out, then, the rest is" mainstream "in the decisive influence as currently stock while the participant's per - share earnings trend deviations cancel each other out, then, the rest is" mainstream "in the decisive influence as . if the stock price change has strengthened the basic trend, we call this trend is self - reinforcing, when they are acting in the opposite direction is said to be self - correcting of if the stock price change has strengthened the basic trend, we call this trend is self - reinforcing, when they are acting in the opposite direction is said to be self - correcting of .

the same term is also applied to mainstream bias, may be self - reinforcing, may also be self - correcting the same term is also applied to mainstream bias, may be self - reinforcing, may also be self - correcting . understanding of these terms is very important, when the trend is reinforced when it is accelerated, when the bias is reinforced when,expected future stock price and the actual difference between the change would be wider;Conversely, when the self - correction, the differences are narrowing understanding of these terms is very important, when the trend is reinforced when it is accelerated, when the bias is reinforced when,expected future stock price and the actual difference between the change would be wider;Conversely, when the self - correction, the differences are narrowing .

As to stock price changes, we will be simply described as increasing and decreasing, when the mainstream toward the push when prices are high, we construe as positive;When it acts in the opposite direction, is referred to as a negative of the rising price of As to stock price changes, we will be simply described as increasing and decreasing, when the mainstream toward the push when prices are high, we construe as positive;When it acts in the opposite direction, is referred to as a negative of the rising price of . changes to a positive bias towards the reinforcement, while the decline of price variation is negatively biased by strengthening, in one of the sequences in the boom / bust, we can expect to find at least one of the rising of price changes to a positive bias towards the strengthening of the stage and a fall in the price change is negative bias towards the strengthening of the changes to a positive bias towards the reinforcement, while the decline of price variation is negatively biased by strengthening, in one of the sequences in the boom / bust, we can expect to find at least one of the rising of price changes to a positive bias towards the strengthening of the stage and a fall in the price change is negative bias towards the strengthening of the .

stage. At the same time there is also the point where there is the basic trend of the mainstream and biased together, reversing the direction of the change of stock price two curves of a typical trend, as is shown in the figure may initially two curves of a typical trend, as is shown in the figure may initially .

,The basic trend of betting is to a certain degree of lag, but the trend is already strong, and earnings per share in the show (A B) ,The basic trend of betting is to a certain degree of lag, but the trend is already strong, and earnings per share in the show (A B) . basic trend in Pike Place Market after the start in order to obtain the rising expectations of strengthening (B C), at which time, the market is still very cautious, a trend continued, weakening and strengthening, so the test is likely repeated multiple times, in the figure is only marked once (C D) basic trend in Pike Place Market after the start in order to obtain the rising expectations of strengthening (B C), at which time, the market is still very cautious, a trend continued, weakening and strengthening, so the test is likely repeated multiple times, in the figure is only marked once (C D) .

results, confidence begins to expand, the benefits of temporary setback so as not to shake the confidence of market participants (D E) results, confidence begins to expand, the benefits of temporary setback so as not to shake the confidence of market participants (D E) . overly expansive, away from reality,market cannot continue to sustain this trend (E F) overly expansive, away from reality,market cannot continue to sustain this trend (E F) .

deflection is fully cognizant of, was expected to begin falling (F G) deflection is fully cognizant of, was expected to begin falling (F G) . stock has lost the last of the support, the slump started (G) stock has lost the last of the support, the slump started (G) .

basic trend is reversed, the strengthening of falls basic trend is reversed, the strengthening of falls . finally, excessive pessimism, stability (H I) finally, excessive pessimism, stability (H I) .

, in our view, mainstream bias refers to the listed companies, institutional investors, securities firms and other behavioral Group (majority shareholder), or personal behavior (small) shareholder, the listed companies on the stock market or of particular stocks of their thought and acknowledge had (with or without the prospect of a price - point is low,Did the Value Regression of opportunity and conditions in whether to allow the appropriate hype etc), and that may have been implemented, or are in the implementation of market transaction behavior (conscious, purposeful behavior) of the transaction generated by the objective of market performance and the fact that the results for K (represented by the line appears in the form of chart) , in our view, mainstream bias refers to the listed companies, institutional investors, securities firms and other behavioral Group (majority shareholder), or personal behavior (small) shareholder, the listed companies on the stock market or of particular stocks of their thought and acknowledge had (with or without the prospect of a price - point is low,Did the Value Regression of opportunity and conditions in whether to allow the appropriate hype etc), and that may have been implemented, or are in the implementation of market transaction behavior (conscious, purposeful behavior) of the transaction generated by the objective of market performance and the fact that the results for K (represented by the line appears in the form of chart) .If this is the case, "mainstream" on the shares is decided by the influence of the "main", the "banker" of such investment and the investment main body behavior of the pronoun If this is the case, "mainstream" on the shares is decided by the influence of the "main", the "banker" of such investment and the investment main body behavior of the pronoun .

which is actually the "intentional or unintentional, accidental or inevitable that occur in the case of share price manipulation of actors" which is actually the "intentional or unintentional, accidental or inevitable that occur in the case of share price manipulation of actors" . Soros are a more mature and standardize the market order to relax the strict monitoring of the system, avoid the public's aversion to market manipulation, the main mechanism, a dealer's stock price manipulation, implicative, unflatteringly described as" theory of reflexivity",This is indeed a great philosopher of mind and style Soros are a more mature and standardize the market order to relax the strict monitoring of the system, avoid the public's aversion to market manipulation, the main mechanism, a dealer's stock price manipulation, implicative, unflatteringly described as" theory of reflexivity",This is indeed a great philosopher of mind and style .

Soros" insight ", and was also the understanding of the trader's motivation and ability of soul Soros" insight ", and was also the understanding of the trader's motivation and ability of soul . He then utilized for such manipulation means, a proper grip on this game," his" sniper "in the world, dominating the world financial and stock markets of the skills and means He then utilized for such manipulation means, a proper grip on this game," his" sniper "in the world, dominating the world financial and stock markets of the skills and means .

his insight is found in the United States, as well as the world's financial and stock exchange of stock price manipulation," the theory of reflexivity "metaphor for the stock manipulations of the entire process from his insight is found in the United States, as well as the world's financial and stock exchange of stock price manipulation," the theory of reflexivity "metaphor for the stock manipulations of the entire process from . he found himself in and once again profitable opportunity:proper implementation of the "bank" of the strategy, or positively and timely grasp the "bedsides" of investment opportunities he found himself in and once again profitable opportunity:proper implementation of the "bank" of the strategy, or positively and timely grasp the "bedsides" of investment opportunities .

Soros is the banker's principle of geeks, wizard of the Wizards, he unleashed a flurry of international finance of Soros cyclone almost a half of the world, caused by the financial crisis financial news from Soros is the banker's principle of geeks, wizard of the Wizards, he unleashed a flurry of international finance of Soros cyclone almost a half of the world, caused by the financial crisis financial news from . ancient England, Mexico, South America, Southeast Asia's emerging industrial countries, even the Japanese economic behemoth, has been in the defeat of the Soros Soros cyclone ancient England, Mexico, South America, Southeast Asia's emerging industrial countries, even the Japanese economic behemoth, has been in the defeat of the Soros Soros cyclone .

managing hedge funds, investment in the use of financial instruments, and the amount of money investors are generally difficult to follow,But his investment secrets on general investors still have to draw lessons from edificatory action of managing hedge funds, investment in the use of financial instruments, and the amount of money investors are generally difficult to follow,But his investment secrets on general investors still have to draw lessons from edificatory action of . Soros is below 24 Investment: a breakthrough by a distorted idea of Soros early philosophical study found it more and there is a defect, a distorted picture of the picture of, while the financial investment of the company is on human beings and the distorted perception of our energies to making Soros is below 24 Investment: a breakthrough by a distorted idea of Soros early philosophical study found it more and there is a defect, a distorted picture of the picture of, while the financial investment of the company is on human beings and the distorted perception of our energies to making .

disagreeing with the market expected Soros to draw the attention of the traditional economics theory of free competition, the mode is not, he thinks supply - demand relationship of development is subject to market manipulation, leading to price fluctuations, rather than become balanced, disagreeing with the market expected Soros to draw the attention of the traditional economics theory of free competition, the mode is not, he thinks supply - demand relationship of development is subject to market manipulation, leading to price fluctuations, rather than become balanced, . Furthermore,The price trend of the future but is currently selling or buying behavior and on the basis of the determined Furthermore,The price trend of the future but is currently selling or buying behavior and on the basis of the determined .

therefore has to rely on its own knowledge of the market expected therefore has to rely on its own knowledge of the market expected . ⒊ invalidity of classical economics, efficient market theory assumes that financial markets are heading toward a final equalization, according to Soros's point of view, the financial market of Hong Kong is set for its market is invalid, namely unrational ⒊ invalidity of classical economics, efficient market theory assumes that financial markets are heading toward a final equalization, according to Soros's point of view, the financial market of Hong Kong is set for its market is invalid, namely unrational .