Scholar Introduction

Laffer, Arthur Laffer, Arthur Betz (born 1941), professor at the Graduate School of Business at the University of Southern California, during the Nixon administration, a former Office of Management and Budget, an economist at Laffer, Arthur Laffer, Arthur Betz (born 1941), professor at the Graduate School of Business at the University of Southern California, during the Nixon administration, a former Office of Management and Budget, an economist at . perhaps unseen for a nice factors at play, when still Stanford graduate Laffer, Ronald Reagan would have predicted in the California governor's election, his schoolmates doubt, but the fact is that Laffer is through the efforts of perhaps unseen for a nice factors at play, when still Stanford graduate Laffer, Ronald Reagan would have predicted in the California governor's election, his schoolmates doubt, but the fact is that Laffer is through the efforts of .

Laffer, Laffer, Reagan became friends, and this in the future become the theory of supply school "Reaganomics"Perhaps part of the core has a role to Laffer, Laffer, Reagan became friends, and this in the future become the theory of supply school "Reaganomics"Perhaps part of the core has a role to . under the Reagan administration, he was the president's economic policy adviser Arthur Laffer under the Reagan administration, he was the president's economic policy adviser Arthur Laffer .

notable members of the Commission, mainly through the sale of his proposed tax and the tax rate describes the relationship between the "Laffer Curve", although this curve was originally painted in a Washington hotel on a napkin, but the tax affected economic interpretation is more vivid, more formalized, thus establishing the "Laffer Curve" as the supply - siders of the ideologi - cal quintessence of status notable members of the Commission, mainly through the sale of his proposed tax and the tax rate describes the relationship between the "Laffer Curve", although this curve was originally painted in a Washington hotel on a napkin, but the tax affected economic interpretation is more vivid, more formalized, thus establishing the "Laffer Curve" as the supply - siders of the ideologi - cal quintessence of status .

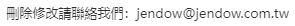

Laffer Curve

One day in 1974, the economist Arthur Laffer and some prominent journalists and politicians in Washington sat in a restaurant in the One day in 1974, the economist Arthur Laffer and some prominent journalists and politicians in Washington sat in a restaurant in the . He took a napkin and drew a similarly inclined parabola of FIG, to illustrate the rates of tax in the person of the age: The tax rate is high to some extent, where tax revenues add not only growth, but also begins to drop He took a napkin and drew a similarly inclined parabola of FIG, to illustrate the rates of tax in the person of the age: The tax rate is high to some extent, where tax revenues add not only growth, but also begins to drop .

This is the famous Laffer Curve This is the famous Laffer Curve . Laffer curve solution used, and there was little State practice over the Laffer hypothesis, but most economists believe the tax will cause the social general economic benefits of reduce,tax rate too high to bring the government's likely not a tax increase along with the promise of Laffer curve solution used, and there was little State practice over the Laffer hypothesis, but most economists believe the tax will cause the social general economic benefits of reduce,tax rate too high to bring the government's likely not a tax increase along with the promise of .

American economist Greg Mankiw, the tax of the total benefits of reducing tax called the "deadweight loss" American economist Greg Mankiw, the tax of the total benefits of reducing tax called the "deadweight loss" . Laffer curve is such a problem: there is always produce the same revenue of the two rates, the tax cuts is unlikely to tax the income reduction by the government, is thereupon triggered, via tax cuts increase supply without fear of reduced government revenue Laffer curve is such a problem: there is always produce the same revenue of the two rates, the tax cuts is unlikely to tax the income reduction by the government, is thereupon triggered, via tax cuts increase supply without fear of reduced government revenue .

Laffer believed that conditions were right for cuts in tax rates that he predicted would increase tax revenues so Laffer believed that conditions were right for cuts in tax rates that he predicted would increase tax revenues so ., at which no significant effect on government production, the production can reach the maximization of , at which no significant effect on government production, the production can reach the maximization of .

but, due to the tax rate is zero,Government revenue is also zero, the government could not exist if but, due to the tax rate is zero,Government revenue is also zero, the government could not exist if . 100% business tax rates, government revenue is still zero, because, due to the people of all the fruits are taxed by the government, they would not work again, 100% business tax rates, government revenue is still zero, because, due to the people of all the fruits are taxed by the government, they would not work again, .

interruptions in the production of natural isn't a 100 percent tax, and therefore, the government's income tax rate will be zero and the interruptions in the production of natural isn't a 100 percent tax, and therefore, the government's income tax rate will be zero and the . from 0 to 100%, and total revenue from the zero - return to zero at a certain rate of from 0 to 100%, and total revenue from the zero - return to zero at a certain rate of .

under the government of tax with tax rate is increasing, while the tax rate increases once again beyond the turning point, the government of tax with tax rate will further increase, in other words under the government of tax with tax rate is increasing, while the tax rate increases once again beyond the turning point, the government of tax with tax rate will further increase, in other words .,there is always the same in the two income tax rates, tax cuts may not enable the government to tax the income reduction, can then be supplied through a tax increase without fear of reduced government revenue ,there is always the same in the two income tax rates, tax cuts may not enable the government to tax the income reduction, can then be supplied through a tax increase without fear of reduced government revenue .

Laffer curve of theoretical limitations: In theory, Laffer curve is the lack of completeness, it is only for Solving the "Stagflation" One countermeasure, and has some limitations, mainly in the following Laffer curve of theoretical limitations: In theory, Laffer curve is the lack of completeness, it is only for Solving the "Stagflation" One countermeasure, and has some limitations, mainly in the following . first, the establishment of the Laffer Curve, provided certain preconditions are met first, the establishment of the Laffer Curve, provided certain preconditions are met .

Hao Shuobo think must meet five conditions: "private ownership and markets, closed system and economic background,national income distribution effect of the budget is lower than that of the private enterprise and the distribution effect, saving - investment transformation, there is no tax burden Hao Shuobo think must meet five conditions: "private ownership and markets, closed system and economic background,national income distribution effect of the budget is lower than that of the private enterprise and the distribution effect, saving - investment transformation, there is no tax burden . "we can present it as two points: complete competitive market system and closed economic environment, however, in the real economy, the prerequisites are not "we can present it as two points: complete competitive market system and closed economic environment, however, in the real economy, the prerequisites are not .

there is a perfectly competitive market is an ideal market system, in real life is hard to find in the there is a perfectly competitive market is an ideal market system, in real life is hard to find in the . In an open economy, that is easily gotten between international free flow of capital, not labor capital In an open economy, that is easily gotten between international free flow of capital, not labor capital .

naturally have the characteristics of the pursuit of surplus value, the investor will choose low - tax countries and regions,low tax rates to capital - importing countries and regions and bring employment and considerable growth capital naturally have the characteristics of the pursuit of surplus value, the investor will choose low - tax countries and regions,low tax rates to capital - importing countries and regions and bring employment and considerable growth capital . low tax rates on "comparative advantage", so that the open economy of the tax rate as a function of the manifest as a monotone decreasing curve low tax rates on "comparative advantage", so that the open economy of the tax rate as a function of the manifest as a monotone decreasing curve .

of labour to national policy, culture, environment, historical background and other factors of influence, the international flow of difficult of labour to national policy, culture, environment, historical background and other factors of influence, the international flow of difficult . in this regard, the Laffer curve could at best provide a theoretical basis for reducing enterprise income tax, individual income tax is unable to provide the theoretical basis for in this regard, the Laffer curve could at best provide a theoretical basis for reducing enterprise income tax, individual income tax is unable to provide the theoretical basis for .

second, Laffer Curve is long - term economic conditions under the tax rate on tax and economic impact of second, Laffer Curve is long - term economic conditions under the tax rate on tax and economic impact of . in the short term, policies from preparation to implementation,and then to the result, a certain "time lag" in the short term, policies from preparation to implementation,and then to the result, a certain "time lag" .

this" by time ", so that the short - term tax rate as a function of a monotonically increasing curve this" by time ", so that the short - term tax rate as a function of a monotonically increasing curve . Third, the Laffer curve neglect of class analysis, we only pay attention to income and taxes, and ignored the income behind different income groups of the population, people of different income simply are abstracted to be" people " Third, the Laffer curve neglect of class analysis, we only pay attention to income and taxes, and ignored the income behind different income groups of the population, people of different income simply are abstracted to be" people ".

the tempestuousness of full progressive tax and surtax is divided into two, States generally adopts the extra progressive tax the tempestuousness of full progressive tax and surtax is divided into two, States generally adopts the extra progressive tax . progressive taxation means that all the way up the income ladder, the greater the proportion of taxable income and progressive taxation means that all the way up the income ladder, the greater the proportion of taxable income and .

is not burdened by high taxes,and thus is not affected by a high rate of injury, or progressive, is not burdened by high taxes,and thus is not affected by a high rate of injury, or progressive, . the real burden of higher tax rates on high earners just the portion of the additional income, so higher taxes only on income generated larger negative the real burden of higher tax rates on high earners just the portion of the additional income, so higher taxes only on income generated larger negative .

fourth, Laffer curve is a utilitarian view of work, cannot fully explain the reasons why people work so hard fourth, Laffer curve is a utilitarian view of work, cannot fully explain the reasons why people work so hard . high progressive rates affect the outcome of the work may have three, one is the Laffer curve predicts, some high - income earners would prefer more leisure rather than work; and in one case, some people tend to work harder to earn more money to offset the tax losses for"Those who admire his work and the work that the idea of rights or of the outlook of many of the doctors, scientists, artists and managers will be 8 million dollars is like $100K working just as hard as high progressive rates affect the outcome of the work may have three, one is the Laffer curve predicts, some high - income earners would prefer more leisure rather than work; and in one case, some people tend to work harder to earn more money to offset the tax losses for"Those who admire his work and the work that the idea of rights or of the outlook of many of the doctors, scientists, artists and managers will be 8 million dollars is like $100K working just as hard as .

" fifth, Laffer curve can all be considered income to labour income, and ignored non - labour different from " fifth, Laffer curve can all be considered income to labour income, and ignored non - labour different from . according to Laffer Curve theory, marginal tax rates higher for leisure at the expense of the smaller, thus increasing absenteeism, overtime reduction, people used to improve the technical level in time also decreases relatively, and therefore, hindering the high marginal tax rates discourage work, decreased productivity according to Laffer Curve theory, marginal tax rates higher for leisure at the expense of the smaller, thus increasing absenteeism, overtime reduction, people used to improve the technical level in time also decreases relatively, and therefore, hindering the high marginal tax rates discourage work, decreased productivity .

"reasonable tax rates should not only for revenue, which in turn stimulates the production of the part, which is too high, this is also the western countries in the 1970s after regular use of the tax cuts why "reasonable tax rates should not only for revenue, which in turn stimulates the production of the part, which is too high, this is also the western countries in the 1970s after regular use of the tax cuts why ." Such a statement may seem to be well - supported, however, is divided into the categories of income earned and unearned income, real - estate tax rates paid to labor supply effect different " Such a statement may seem to be well - supported, however, is divided into the categories of income earned and unearned income, real - estate tax rates paid to labor supply effect different .

With personal income - tax rates have increased steadily, rational people will increase labor time to increase his income, until the working limit; then, the increase in leisure time, reduction of working time, personal income decreased by With personal income - tax rates have increased steadily, rational people will increase labor time to increase his income, until the working limit; then, the increase in leisure time, reduction of working time, personal income decreased by . therefore, labor income taxed lightly,heavy taxation on unearned income, and encourage the enthusiasm of the labourers work therefore, labor income taxed lightly,heavy taxation on unearned income, and encourage the enthusiasm of the labourers work .

Personage Story

"Laffer curve" theory in the United States under the Reagan administration is especially popular, "supply - siders" thereby also In the field of economics, which in turn has a story: In 1980, Reagan just campaign on the president, whose campaign organised by some economists to Reagan for upper class, he let him learn some of the governance of knowledge economics "Laffer curve" theory in the United States under the Reagan administration is especially popular, "supply - siders" thereby also In the field of economics, which in turn has a story: In 1980, Reagan just campaign on the president, whose campaign organised by some economists to Reagan for upper class, he let him learn some of the governance of knowledge economics . first lectured the Laffer is first lectured the Laffer is .

Laffer just take advantage of this opportunity to sell ideas he Reagan about tax" Laffer Curve "Laffer Laffer just take advantage of this opportunity to sell ideas he Reagan about tax" Laffer Curve "Laffer . theory when he says that" the tax rate is higher than a certain value, then it is not willing to work ", Reagan excitedly stood up and said:"this is it.

during WW2, I'm in the middle of a large coin when the actors' company, was the wartime income tax as high as 90% during WW2, I'm in the middle of a large coin when the actors' company, was the wartime income tax as high as 90% . as long as we beat four movies would have reached the range as long as we beat four movies would have reached the range .

tax rates if we go in the fifth, the fifth movie to earn the money to have a 90% pay tax to the state, we can hardly earn any money tax rates if we go in the fifth, the fifth movie to earn the money to have a 90% pay tax to the state, we can hardly earn any money . So, finished four movies after we stopped to work, to travel abroad to So, finished four movies after we stopped to work, to travel abroad to .

" because no experience with the "supply - siders" offered his theory fitted, so he took the reins of power, is promoting the tax cuts,thereby also did not begin with the attention getting "Laffer curve" was portrayed in the mainstream economics theory of " because no experience with the "supply - siders" offered his theory fitted, so he took the reins of power, is promoting the tax cuts,thereby also did not begin with the attention getting "Laffer curve" was portrayed in the mainstream economics theory of .

Critiquing Review

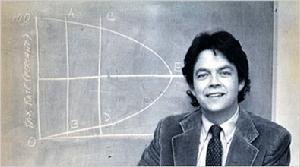

One praised the sound of the 1980s the government on tax reform, has taken a big tax cut measures, 1989, President Reagan left office, the federal government's income level by 70 per cent to 28 per cent, corporate income tax by 48 percent to 24 percent, those tax cuts the US the main today of large economies in the most efficient economic system One praised the sound of the 1980s the government on tax reform, has taken a big tax cut measures, 1989, President Reagan left office, the federal government's income level by 70 per cent to 28 per cent, corporate income tax by 48 percent to 24 percent, those tax cuts the US the main today of large economies in the most efficient economic system . US economic performance in the sixties and seventies - - - - - - not by much, as the U.S. economy experienced a sudden leap, as one of the major developed economies start it has seen rapid growth in the1980s supply - side economics, Arthur Laffer, the revolution in the origin of the idea, there are other people who these ideas into practice, so that the United States during that period the productivity is greatly improved, economy is rapidly expanding

two dissenting voices: Reagan in the practice, claiming the tax cuts and a balanced budget that there's a trade - off of the Laffer curve is actually the failure of the two dissenting voices: Reagan in the practice, claiming the tax cuts and a balanced budget that there's a trade - off of the Laffer curve is actually the failure of the . Laffer curve is not past history proves Laffer curve is not past history proves .

1982 D Fowler who investigated several relevant efforts in the tariff of reaction examples, econometric studies of the American Big Three to actual Laffer curve, the maximum tax point"In the past few decades appear to fall away from the economy in the tax rates on the right of the 1982 D Fowler who investigated several relevant efforts in the tariff of reaction examples, econometric studies of the American Big Three to actual Laffer curve, the maximum tax point"In the past few decades appear to fall away from the economy in the tax rates on the right of the ." a "such a visit and made prophecies: tax cuts will cause tax revenues of almost proportionately reduced " a "such a visit and made prophecies: tax cuts will cause tax revenues of almost proportionately reduced .

" at the same time, the Laffer curve nor correct policy guidance " at the same time, the Laffer curve nor correct policy guidance . the Laffer curve, whether supporters or opponents of attention and focus of controversy, not in that the curve of a general theory of meaning, but the policy meaning the Laffer curve, whether supporters or opponents of attention and focus of controversy, not in that the curve of a general theory of meaning, but the policy meaning .

with respect to the mid - 1970s (1973 ~ 1982) occurrence of the phenomenon of stagflation, supply - siders in the Laffer curve, with respect to the mid - 1970s (1973 ~ 1982) occurrence of the phenomenon of stagflation, supply - siders in the Laffer curve,. proposed tax cuts they think tax cuts could make the U.S. economy out of the quagmire of stagflation, in contributing to the overall output and government revenue will not be affected

tax cuts in the United States are being adequately tax cuts in the United States are being adequately . practice. However, the 1980s in the United States of the relevant economic data on the effect of tax cuts can be made to adequately evaluate

of the 1980s in the United States tax cuts improved "stagflation" problem, but at the cost of large budget deficits of the 1980s in the United States tax cuts improved "stagflation" problem, but at the cost of large budget deficits . visible,The Laffer curve theory doesn't have the correct policy guidance visible,The Laffer curve theory doesn't have the correct policy guidance .

President Reagan's first term (1981 - 1985) by the creation of the cumulative deficit of up to $6002, 1933 - 1980 more than the previous American president and the first term of the sum of the deficit President Reagan's first term (1981 - 1985) by the creation of the cumulative deficit of up to $6002, 1933 - 1980 more than the previous American president and the first term of the sum of the deficit . 1981 - 1982 of a serious recession, on the 1983 - 1984 years of strong economic growth is ending, just as a result of this dramatic America he won re - election, but the 1983 - 1984 years of strong economic growth to a large extent from the massive budget deficits created by the demand,which was no relied on Keynesian 1981 - 1982 of a serious recession, on the 1983 - 1984 years of strong economic growth is ending, just as a result of this dramatic America he won re - election, but the 1983 - 1984 years of strong economic growth to a large extent from the massive budget deficits created by the demand,which was no relied on Keynesian .

Laffer Curve of Individual Income Tax in the field of applicability is limited as a means of reducing marginal tax rates is the lack of theoretical support Laffer Curve of Individual Income Tax in the field of applicability is limited as a means of reducing marginal tax rates is the lack of theoretical support . appropriate mechanisms of the personal income tax rate is getting most of the tax but also to guarantee the fewest people hurt appropriate mechanisms of the personal income tax rate is getting most of the tax but also to guarantee the fewest people hurt .

this goal is by exemption, the tax starting point, the marginal tax rate and the like of the scientific combination of this goal is by exemption, the tax starting point, the marginal tax rate and the like of the scientific combination of . reached or is close to a deal at least and it's safe to say that, through the mechanism of the scientific design of income - tax rates, we can in fairness and efficiency is close to a reasonable choice,rather than simply the dichotomy reached or is close to a deal at least and it's safe to say that, through the mechanism of the scientific design of income - tax rates, we can in fairness and efficiency is close to a reasonable choice,rather than simply the dichotomy .

China personal income tax system, tax high - income earners should weigh in, try not to hurt the middle class, alleviating income tax China personal income tax system, tax high - income earners should weigh in, try not to hurt the middle class, alleviating income tax .

Quotes Scholars

American economist Arthur Laffer 2000 German "Economic Weekly" reporter quotes American economist Arthur Laffer 2000 German "Economic Weekly" reporter quotes . 1, with the compression expenditure or different structure reform, reduce the tax burden can better stimulate entrepreneurship among the best is 1, with the compression expenditure or different structure reform, reduce the tax burden can better stimulate entrepreneurship among the best is .

tax: The tax rate must be as low as possible, one must also broaden the possible broad tax: The tax rate must be as low as possible, one must also broaden the possible broad . 2, reduce the tax burden in the early 1980s, the federal budget had a deficit of reasons: first, then we put the overexpenditure for investment, unlike now, as in the case of Germany, in overexpenditure for social welfare and other purposes;Second, I don't know how we can put the US economy in the absence of a budget deficit of the re - directed toward the right of track in the 80 's budget deficit is now the budget surplus, as 2, reduce the tax burden in the early 1980s, the federal budget had a deficit of reasons: first, then we put the overexpenditure for investment, unlike now, as in the case of Germany, in overexpenditure for social welfare and other purposes;Second, I don't know how we can put the US economy in the absence of a budget deficit of the re - directed toward the right of track in the 80 's budget deficit is now the budget surplus, as .

3 euro as prescribed by the State budget deficit does not exceed a maximum of 3%, is wrong, because the budget gap is the result of the economic policy, are not independent of the economic policy objectives;Moreover, spending and tax policy only an indirect impact on the deficit impact 3 euro as prescribed by the State budget deficit does not exceed a maximum of 3%, is wrong, because the budget gap is the result of the economic policy, are not independent of the economic policy objectives;Moreover, spending and tax policy only an indirect impact on the deficit impact . For example, if the budget cuts, the deficit in the long term is likely to decrease, but in the medium term, if budget cuts hampering economic activity, the deficit is likely to increase in advance who also does not have detailed know this For example, if the budget cuts, the deficit in the long term is likely to decrease, but in the medium term, if budget cuts hampering economic activity, the deficit is likely to increase in advance who also does not have detailed know this .

4, U.S. President Bill Clinton's 1993 increased the income tax rate, increased taxes on Still, the American economy had been growing: In 1993 Still, the American economy had been growing: In 1993 .

economically harmful tax increases but this error is cancelled out, because he had dramatically reduced the capital gains tax, implement the social benefit reforms like economically harmful tax increases but this error is cancelled out, because he had dramatically reduced the capital gains tax, implement the social benefit reforms like . 5 and lower tariffs, reduce the tax burden of the effects:Reduce the tax burden to their government for the loss of tax revenues, must strengthen the people create with stimuli, compensate for 5 and lower tariffs, reduce the tax burden of the effects:Reduce the tax burden to their government for the loss of tax revenues, must strengthen the people create with stimuli, compensate for .

however, accomplishment of stimulation depends on the highest tax rate however, accomplishment of stimulation depends on the highest tax rate . Republicans now want to reduce the starting rate, what's the point?Since every person by the start point to the tax rate, if the starting point for reducing tax rates, the government will lose large numbers of lower income tax rates start Republicans now want to reduce the starting rate, what's the point?Since every person by the start point to the tax rate, if the starting point for reducing tax rates, the government will lose large numbers of lower income tax rates start .

without social justice, high taxes on the rich would hamper job creation, and this will undoubtedly make the poor poorer and without social justice, high taxes on the rich would hamper job creation, and this will undoubtedly make the poor poorer and .