Company Profile

Changjiang Securities Co., Ltd., formerly Hubei Securities Company, founded in 1991, the People's Republic of China on the People's Bank of China, a company incorporated in the Wuhan February 23, 2000, as approved by the CSRC approval, company capital increase to 2.9 billion yuan, while at the same time, the name was changed to "Changjiang Securities Co., Ltd.,"

in December 2001, as approved by the CSRC approval, company shares or capital to 20 billion yuan (US $ in December 2001, as approved by the CSRC approval, company shares or capital to 20 billion yuan (US $., 19 December 2007, the China Securities Regulatory Commission approval, the company was renamed as" Changjiang Securities Co., Ltd., and on 27 December formally listed in Shenzhen Stock Exchange,stock exchange (000783

companies and quality assets, net assets and net capital two indexes about league has always maintained a relatively front position companies and quality assets, net assets and net capital two indexes about league has always maintained a relatively front position . in December 2004, the company became the first to enter the ranks of the innovative pilot of one of the eight in December 2004, the company became the first to enter the ranks of the innovative pilot of one of the eight .

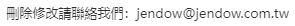

January 2005, entrusted by the CSRC, the company hosting the original Dapeng Securities brokerage business, and in June acquired Dapeng Securities brokerage business, innovation - experimental companies to dispose in the market risk of securities, for the first time in the January 2005, entrusted by the CSRC, the company hosting the original Dapeng Securities brokerage business, and in June acquired Dapeng Securities brokerage business, innovation - experimental companies to dispose in the market risk of securities, for the first time in the . Now, the company has completed a preliminary framework of securities company, which owns the Changjiang bnp paribas peregrine securities co., ltd.,Changjiang Futures Co. Ltd, Yangtze growth capital investment Co., Ltd, Chang Xin Asset Management Co., Ltd., and Fund Management Limited and five wholly owned subsidiaries of company

has been controlled in 22 provinces, autonomous regions, municipalities directly under the Central Government, more than 50 cities, as well as the establishment of 80 + branches, has gradually grown into a nationwide service network has been controlled in 22 provinces, autonomous regions, municipalities directly under the Central Government, more than 50 cities, as well as the establishment of 80 + branches, has gradually grown into a nationwide service network . since 2005, the company has been awarded "Top Ten Brands of China's securities industry is" since 2005, the company has been awarded "Top Ten Brands of China's securities industry is" .

2007, in the" Chinese brokerages Award ", the company was awarded the" Most brokerage force development award " 2007, in the" Chinese brokerages Award ", the company was awarded the" Most brokerage force development award ". 1 1.

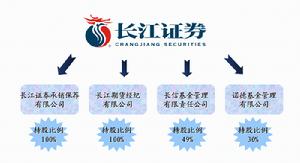

Company Structure

* For details, see figure 2* For details, see figure 2.

Development Course

1991 Law of the People's Republic of China on the People's Bank of China, the People's Bank of China and approved by the Hubei, Hubei Changjiang Securities Co., Ltd. (formerly) founded the company with a paid - in capital of RMB 1,700, 000.00 Yuan is contributed by the People's Bank of China branch in

1991 Law of the People's Republic of China on the People's Bank of China, the company participated for the first time together with the Ministry of Finance of Bonds, established the company's government securities primary dealer status 1991 Law of the People's Republic of China on the People's Bank of China, the company participated for the first time together with the Ministry of Finance of Bonds, established the company's government securities primary dealer status . 23 April 1991, the company's first formal business department to open to public 23 April 1991, the company's first formal business department to open to public .

13 March 1992, China's Hubei province, People's Bank of China branch offices for approval,companies to issue yuan bonds China's Hubei Province, 2000 investment benefit (now merged with Chile securities funds), the industry over the years using the securities investment business innovation 13 March 1992, China's Hubei province, People's Bank of China branch offices for approval,companies to issue yuan bonds China's Hubei Province, 2000 investment benefit (now merged with Chile securities funds), the industry over the years using the securities investment business innovation . 20 June 1992, the securities company in Shanghai, which is the company in Hubei Province outside 'first Business 20 June 1992, the securities company in Shanghai, which is the company in Hubei Province outside 'first Business .

1992 on Aug. 28, in Central China's first opened in Shanghai and Shenzhen A - shares on the strange land agency business of trading of the securities company (now Wuhan Hankou business department) Sales Department 1 - 2,3rd Building was officially opened in the 18 January 1993,U.S. company with Merrill Lynch's mainland companies to go public overseas etc. formally signed a cooperation agreement with

This is the company's first overseas securities exchanges and business cooperation This is the company's first overseas securities exchanges and business cooperation . dated 3 January 1994, the company has worked for the first time as the main underwriter and the Listing Sponsor of "Huaxin" listing, the success achieved in the field of investment banking of dated 3 January 1994, the company has worked for the first time as the main underwriter and the Listing Sponsor of "Huaxin" listing, the success achieved in the field of investment banking of .

breakthrough in late 1995, the company's first five - year plan "Hubei Securities Limited development strategies for the next five years", which was to later have profound significance for the development of thematic reports breakthrough in late 1995, the company's first five - year plan "Hubei Securities Limited development strategies for the next five years", which was to later have profound significance for the development of thematic reports . 1996, lead underwriter of stock advancers is ranking targets, the Chinese company in the seventh column,for the first time China's top 10 brokerages listed 1996, lead underwriter of stock advancers is ranking targets, the Chinese company in the seventh column,for the first time China's top 10 brokerages listed .

On 26 May 1997, the company served as main underwriter and the Listing Sponsor of the quota within a year plans to issue stocks in what will be the first large - cap value stocks Three Gorges and Gezhouba " On 26 May 1997, the company served as main underwriter and the Listing Sponsor of the quota within a year plans to issue stocks in what will be the first large - cap value stocks Three Gorges and Gezhouba ". the issuance and listing of 21 October 1997, the lead underwriter of the company's first shares" Dahua B - shares listed on the the issuance and listing of 21 October 1997, the lead underwriter of the company's first shares" Dahua B - shares listed on the .

in 1997, in accordance with the Law of the People's Republic of China on the People's Bank of China branches at all levels with the investment or shareholding in a securities company of the de - linking of the People's Republic of China, the company and PBC in 1997, in accordance with the Law of the People's Republic of China on the People's Bank of China branches at all levels with the investment or shareholding in a securities company of the de - linking of the People's Republic of China, the company and PBC . decoupling at the same time, the company enlarged its share to 1. 6 billion yuan,China Gezhouba Group Corporation, or the like 13 enterprises become shareholders of the Company after the capital increase

on 11 November 1998, as approved by the CSRC approval, company capital reserve to be dispensed and the annual dividend on the portion of subscribed capital, the firm's capital to 3 billion, with on 11 November 1998, as approved by the CSRC approval, company capital reserve to be dispensed and the annual dividend on the portion of subscribed capital, the firm's capital to 3 billion, with . on 26 March 1999, the company initiated the establishment of Changsheng Fund Management Co., a process of opening an

on April 2, 1999, the company initiated the establishment of the fund was" Tongyi Fund "through online pricing issuance on April 2, 1999, the company initiated the establishment of the fund was" Tongyi Fund "through online pricing issuance . of 23 December 1999,lead underwriter of the company's first large - scale corporate "'98 Qingjiang debt" of 23 December 1999,lead underwriter of the company's first large - scale corporate "'98 Qingjiang debt" .

issuance of the company and was its" Three Gorges", "CITIC", "Baosteel", "Dongfeng" and many other national and corporate - bond and assistant chief issuance of the company and was its" Three Gorges", "CITIC", "Baosteel", "Dongfeng" and many other national and corporate - bond and assistant chief . February 23, 2000, as approved by the CSRC approval, company capital increase to 2.9 billion yuan, while at the same time, the name was changed to "Changjiang Securities Limited Liability Company Law of the People's Republic of China, Shanghai Haixin Group Co., Ltd.; and a number of other famous Hubei Province outside of listed companies and large enterprises have become the majority shareholders and

on 12 May 2000,company - operated with Agricultural Bank of China (Head Office) signed a comprehensive cooperation framework agreement, so as to realize in cooperation is the important progress that on 12 May 2000,company - operated with Agricultural Bank of China (Head Office) signed a comprehensive cooperation framework agreement, so as to realize in cooperation is the important progress that . dated 14 September 2000, Changjiang Securities development strategies of the advisory committee of the CSRC who was the first Chairman of the Advisory Committee with Mr. Li Hongru, the founding director of the

In the meantime, the second five - year plan for the future, "Changjiang Securities Co., Ltd from 2001 to 2005 development strategy" launched 8 October 2000, the headquarters relocated to Intelligent Office Building, Changjiang Securities, thus ending the history of the positions of the plurality of dispersed office 8 October 2000, the headquarters relocated to Intelligent Office Building, Changjiang Securities, thus ending the history of the positions of the plurality of dispersed office .

the same day, the company's website "net long"revision upgrades, Securities E - Commerce started the same day, the company's website "net long"revision upgrades, Securities E - Commerce started . 9 October 2000, upon the approval of the People's Bank of China, the company entered the national interbank borrowing market and bond market 9 October 2000, upon the approval of the People's Bank of China, the company entered the national interbank borrowing market and bond market .

in October 2001, the company management structure to achieve a great transformation in the north, Shanghai, south and southwest of the Four Headquarters can revoke the authorization, the brokerage unit's headquarters was established, the Company completed a move from "block" to the "strip" of change in October 2001, the company management structure to achieve a great transformation in the north, Shanghai, south and southwest of the Four Headquarters can revoke the authorization, the brokerage unit's headquarters was established, the Company completed a move from "block" to the "strip" of change . in December 2001, as approved by the CSRC approval, company shares or capital to 20 billion yuan and Qingdao Haier Investment Development Co., Ltd. to become the largest shareholder

2002 Mar. 7,Company with BNP Paribas signed "the establishment of a Sino - foreign joint venture securities companies within the framework of the Agreement, and on a long - stalled cooperation deal this whether China join the WTO, China's first joint venture one this whether China join the WTO, China's first joint venture one .

9 August 2002, the company held with CITIC" silver certificate beyond financial plan "cooperation signing ceremony and the product promotion of 9 August 2002, the company held with CITIC" silver certificate beyond financial plan "cooperation signing ceremony and the product promotion of . This is the first in China to redirect its energies from the normative task of the collective wealth This is the first in China to redirect its energies from the normative task of the collective wealth .

in their business, the company has evolved from the traditional mode of financing, securities and wealth - management cooperation financing of business development, on 28 April 2003,company had sponsored the establishment of Chang Xin Asset Management Co., Ltd., and the process of opening, and fund management businesses into a new phase on 26 November 2003, the company with a BNP Paribas joint venture establishment of Changjiang BNP Paribas peregrine, as the limited liability company to begin operations, the company's investment banking division was transferred to a new platform on 26 November 2003, the company with a BNP Paribas joint venture establishment of Changjiang BNP Paribas peregrine, as the limited liability company to begin operations, the company's investment banking division was transferred to a new platform .

2003, the company realizes the centralized financial management, financial financial businesses appealing to the government headquarters, that intends to use the Business Department of Headquarters staff, and implement regular rotation and 2003, the company realizes the centralized financial management, financial financial businesses appealing to the government headquarters, that intends to use the Business Department of Headquarters staff, and implement regular rotation and . 10 March 2004, the company served as main underwriters and sponsors of the "high speed"2. 8 million A shares listing

This is a listing of Hubei Province during the year's first large - cap value stocks, is also the company as the main underwriter for shares of stock in circulation maximum This is a listing of Hubei Province during the year's first large - cap value stocks, is also the company as the main underwriter for shares of stock in circulation maximum . 16 March 2004, the company with the Xiamen Marine Industries (Group) Co., Ltd., signed a "recommended re - listing, the Agency Share Transfer Agreement, which marked the Agency Share Transfer dealers for

curtain on 17 June 2004, the corporation with Hangzhou Hundsun Electronics Company signed a large contract the concentrated trade item of the software development, companies with large centralized transaction system officially entered the implementation stage curtain on 17 June 2004, the corporation with Hangzhou Hundsun Electronics Company signed a large contract the concentrated trade item of the software development, companies with large centralized transaction system officially entered the implementation stage . on 16 September 2004,Futures Brokerage Company, controlled by the limited liability company held a ceremony for on 16 September 2004,Futures Brokerage Company, controlled by the limited liability company held a ceremony for .

company. It is the first to enter the futures industry securities on 1 December 2004, released a statement to the Securities Association of China, including companies of 5 securities firms had become engaged to innovation - related activities of securities companies to pilot securities on 1 December 2004, released a statement to the Securities Association of China, including companies of 5 securities firms had become engaged to innovation - related activities of securities companies to pilot .

, which meant that the company became the first to enter the ranks of the innovative pilot of one of the , which meant that the company became the first to enter the ranks of the innovative pilot of one of the . home 8 December 29, 2004, the CSRC approved the division of the company's restructuring programme home 8 December 29, 2004, the CSRC approved the division of the company's restructuring programme .

through the separation of restructuring, stripping non - securities assets, the company toward its shareholding reform,Initial Public Offering and Listing of Stocks a crucial first step in through the separation of restructuring, stripping non - securities assets, the company toward its shareholding reform,Initial Public Offering and Listing of Stocks a crucial first step in . Jan. 14, 2005, entrusted by the CSRC, the company hosted Dapeng Securities brokerage business and 31 of the Securities Sales and 2 stock service

dated 28 March 2005, the company "Chaoyue Money Changjiang No. 1" in the aggregate asset management plan is an application in respect of the approval of the CSRC This is the "Tentative MeasuresProcedures for Administration Assets of Clients of Securities Company" formally implemented since the first approved issuance of only 3 aggregated financial products, and also one of the first to extract only the "risk reserve" of wealth management products (WMPs) This is the "Tentative MeasuresProcedures for Administration Assets of Clients of Securities Company" formally implemented since the first approved issuance of only 3 aggregated financial products, and also one of the first to extract only the "risk reserve" of wealth management products (WMPs) .

on 26 November 2005,Companies involved in the creation of the Wuhan Iron and Steel warrants from the listing, which is creating is first introduced in the domestic securities market on 26 November 2005,Companies involved in the creation of the Wuhan Iron and Steel warrants from the listing, which is creating is first introduced in the domestic securities market . on 19 January 2006, the Second (2005) annual conference of the China Brand Summit "at the Great Hall of the People in Beijing, while announcing the Second (2005) 10 influence trademark Philanthropy award winners, the company has been awarded" Top Ten Brands of China's securities industry is the title of on 19 January 2006, the Second (2005) annual conference of the China Brand Summit "at the Great Hall of the People in Beijing, while announcing the Second (2005) 10 influence trademark Philanthropy award winners, the company has been awarded" Top Ten Brands of China's securities industry is the title of .

May 11, 2006, the China Securities Regulatory Commission (CSRC) issued an official document, agreed on the establishment of the Fund Management Co., Ltd., This is the first domestic holdings by foreign investors of the fund management company,Fund company, American Writing in the Wall Street Journal at fund company, and Tsinghua Holdings Ltd, which the company invested 30 million yuan, accounting for 30% This is the first domestic holdings by foreign investors of the fund management company,Fund company, American Writing in the Wall Street Journal at fund company, and Tsinghua Holdings Ltd, which the company invested 30 million yuan, accounting for 30% .

9 December 2006, the company and the China Petroleum and Chemical Corporation's backdoor listing of SRCC Company agreed a preliminary intent, the Board of Directors issued a public notice announcing the 11th day of December in the company's shares will remain suspended hence 9 December 2006, the company and the China Petroleum and Chemical Corporation's backdoor listing of SRCC Company agreed a preliminary intent, the Board of Directors issued a public notice announcing the 11th day of December in the company's shares will remain suspended hence . This marked the listing of the company has taken a historic step This marked the listing of the company has taken a historic step .

March 2007With the approval of the CSRC, Changjiang BNP Paribas peregrine, as the limited liability company has been renamed as" Changjiang bnp paribas peregrine securities co., ltd. (hereinafter referred to as" Yangtze ") underwriting is a company wholly owned by the Yangtze River, the first of its kind in the country specializing in investment banking, specialized subsidiaries, domicile and headquarters office is located at underwriting is a company wholly owned by the Yangtze River, the first of its kind in the country specializing in investment banking, specialized subsidiaries, domicile and headquarters office is located at .

Shanghai on April 16, 2007, the Nord company in which the fund company issued its first fund" Lord Value Advantage Fund "and wowed investors, of orders in the first 24 hours and 150 billion yuan, far exceeding 80 billion yuan of the fund's Limit on Shanghai on April 16, 2007, the Nord company in which the fund company issued its first fund" Lord Value Advantage Fund "and wowed investors, of orders in the first 24 hours and 150 billion yuan, far exceeding 80 billion yuan of the fund's Limit on . Aug. 11, 2007the company's customers transaction settlement funds by a third party and the launch of construction

on 19 August 2007, the CSRC approved the futures of the Yangtze River by 3,000 yuan of registered capital of 1 billion yuan, and the alteration of the equities of the company became a wholly owned subsidiary of on 19 August 2007, the CSRC approved the futures of the Yangtze River by 3,000 yuan of registered capital of 1 billion yuan, and the alteration of the equities of the company became a wholly owned subsidiary of . dated 20 August 2007, the company has spent years trading large centralized dated 20 August 2007, the company has spent years trading large centralized .

work was completed by 6 December 2007, the company received a CSRC issued the Circular on the approval of the Company to targeted,Major asset sales as well as the New Shares will be absorbed by Changjiang Securities Co., Ltd., a notification "(Zheng Jian Gong Si Zi 2007 No. 196), the formal approval of the Company's backdoor listing plan for This marked the sixth company to become the country's successful listing of the securities company This marked the sixth company to become the country's successful listing of the securities company .

on 27 December 2007, the company listed in Shenzhen Stock Exchange held a ceremony marking the official landing on 27 December 2007, the company listed in Shenzhen Stock Exchange held a ceremony marking the official landing . the A - share market since 2008, the company started to push ahead with a retail customer business system reform the A - share market since 2008, the company started to push ahead with a retail customer business system reform .

on Feb. 26, 2008, the collective wealth - management company," Chaoyue Money, No. 2, approved a plan called the "Fund Manager".open - ended, non - limitative aggregate asset management plan, which is distinguished by the fact that in protecting the interests of innovative, i.e. the company with a certain amount of own funds to enjoy limited liability on March 22, 2008 and Apr. 18, the company and China Merchants Bank and Industrial and Commercial Bank of China has successively signed a strategic cooperation agreement, is strongly in this cooperation is a significant breakthrough

April 16, 2008, the Company is approved by the CSRC futures IB business qualifications, the company provide new business opportunities for the April 16, 2008, the Company is approved by the CSRC futures IB business qualifications, the company provide new business opportunities for the . on January 20, 2009by the company initiated and established Hubei Changjiang Securities on January 20, 2009by the company initiated and established Hubei Changjiang Securities .

Charity Foundation was formally established on May 25, 2009, the company obtained the approval of the Hubei Bureau of, the implementation of the broker system whereby Charity Foundation was formally established on May 25, 2009, the company obtained the approval of the Hubei Bureau of, the implementation of the broker system whereby ., the company became the second couple, also. It is the center of the first embodiment of securities brokerages

early July 2009, the China Securities Regulatory Commission (CSRC) has announced the 2009 securities classified supervision evaluation results, the company successfully promoted to the Class A Class A early July 2009, the China Securities Regulatory Commission (CSRC) has announced the 2009 securities classified supervision evaluation results, the company successfully promoted to the Class A Class A . on November 13, 2009, the company allotted or payment at the conclusion of the work, the subscription rate was 98. 8046%

this rationing for the first time since the financing,All the company's business is strong capital support, the company's long - term development objectives and lay a solid foundation for the this rationing for the first time since the financing,All the company's business is strong capital support, the company's long - term development objectives and lay a solid foundation for the . December 8, 2009, the Yangtze River and the growth capital investment limited company was established, marking the company's direct investment business officially started December 8, 2009, the Yangtze River and the growth capital investment limited company was established, marking the company's direct investment business officially started .

3 3.

Brand Identity

Si Hui Creative Interpretation

"Long Teng" is a flag of the image of the subject's Changjiang Securities "Long Teng" is a flag of the image of the subject's Changjiang Securities . Yangtze River is our mother river, endlessly flowing;Long is the totem of the chinese nation, as a symbol of a struggle of the spirit of the Yangtze River is our mother river, endlessly flowing;Long is the totem of the chinese nation, as a symbol of a struggle of the spirit of the .

to the "Long Teng" identified the body, the center of Changjiang Securities career flourishing, thriving to the "Long Teng" identified the body, the center of Changjiang Securities career flourishing, thriving . blue and red emblem of a division two blue basic color blue and red emblem of a division two blue basic color .

represents reason, and deep;The red symbolizes the prosperous, vibrant represents reason, and deep;The red symbolizes the prosperous, vibrant . blue and red, indicating that Yangtze River Securities, and advocating robust, vibrant and innovative blue and red, indicating that Yangtze River Securities, and advocating robust, vibrant and innovative .

Standard Color

using the combination specificationusing the combination specification.

Changjiang Securities of the standard color is blue and red, both of which consist of the primary color blue Changjiang Securities of the standard color is blue and red, both of which consist of the primary color blue . C100 M40 K52 Y0;PANTONE 540 CVC red M100 Y100;PANTONE 1788 CVC 2X 4 C100 M40 K52 Y0;PANTONE 540 CVC red M100 Y100;PANTONE 1788 CVC 2X 4.

Enterprise Culture

Article 1 Of Our Vision

- - - - - - becoming a comprehensive financial services in the domestic first - class financial enterprises- - - - - - becoming a comprehensive financial services in the domestic first - class financial enterprises.

Article 2 Of Our Mission

Choi shared growth convergenceChoi shared growth convergence.

Article 3 The Core Values

the pursuit of excellencethe pursuit of excellence.

Article 4 The Management Idea

operating integrity of the normative operation of innovative developmentoperating integrity of the normative operation of innovative development.

Article 5 Business Development Strategies;

customer - oriented research drive technology leading internal control in advancecustomer - oriented research drive technology leading internal control in advance.

Article 6 Of The Human Resources Management Idea In

in an amount suitable for the performance of the performance fair competition prevails, long effective inspiring 5in an amount suitable for the performance of the performance fair competition prevails, long effective inspiring 5.

Main Business

The company now has 66 branch offices, 6 Services, has formed a nationwide service network The company now has 66 branch offices, 6 Services, has formed a nationwide service network . company has a stable, high quality professional marketing team, establishing a unified national customer service center, are formed of organic, whole of the financial system and marketing system of customer service company has a stable, high quality professional marketing team, establishing a unified national customer service center, are formed of organic, whole of the financial system and marketing system of customer service .

for mature marketing management and the mode of operation of the fund shares traded steadily year after year, 2008, the company launched a retail customer business system reform, develop customer basis, to adapt to market developments and changes in the brokerage business and fierce competition;actively marketing activities, develop marketing channels and community marketing;establish the internal trainer team, strengthening the marketing personnel training;According to customer classification, the classification of the products, the layered service is determined according to the principle of customer - service systems have been used in the respective build - up of the system, a customer service job for mature marketing management and the mode of operation of the fund shares traded steadily year after year, 2008, the company launched a retail customer business system reform, develop customer basis, to adapt to market developments and changes in the brokerage business and fierce competition;actively marketing activities, develop marketing channels and community marketing;establish the internal trainer team, strengthening the marketing personnel training;According to customer classification, the classification of the products, the layered service is determined according to the principle of customer - service systems have been used in the respective build - up of the system, a customer service job . company as of 2008 deals totaling 10604. 57 billion yuan, the industry ranked 19, wherein the oil - trading stock funds 7806. 38 billion yuan, with a market share of 1. 43%

Securities Brokerage Business

company has branch offices in 56 licence and has 50 branch offices, 11 Services, in its outlets in the country, and gradually build up the Yangtze River Delta, Pearl River Delta, Bohai Bay, China, Central and western region have been identified as five key business company has branch offices in 56 licence and has 50 branch offices, 11 Services, in its outlets in the country, and gradually build up the Yangtze River Delta, Pearl River Delta, Bohai Bay, China, Central and western region have been identified as five key business . company has a stable, high quality professional marketing team, establishing a unified national customer service center, are formed of organic, whole of the financial system and marketing system of customer service company has a stable, high quality professional marketing team, establishing a unified national customer service center, are formed of organic, whole of the financial system and marketing system of customer service .

for mature marketing management and the mode of operation of the fund shares traded steadily increasing from year to year of 2006, the proxy transaction volume in excess of 2989 billion yuan,Market and 16th among for mature marketing management and the mode of operation of the fund shares traded steadily increasing from year to year of 2006, the proxy transaction volume in excess of 2989 billion yuan,Market and 16th among .

Investment Banking

Since the establishment of the company before taking up a total of more than 100 domestic listed company's B - share and assistant chief underwriters and the Listing Sponsor Since the establishment of the company before taking up a total of more than 100 domestic listed company's B - share and assistant chief underwriters and the Listing Sponsor . between 1997 and 1999, the number of underwriting companies for three consecutive years in the industry in top 10 between 1997 and 1999, the number of underwriting companies for three consecutive years in the industry in top 10 .

2003, the company has set up a joint venture with BNP Paribas Changjiang BNP Paribas peregrine, as the limited liability company, the investment bank to hand over the company's 2003, the company has set up a joint venture with BNP Paribas Changjiang BNP Paribas peregrine, as the limited liability company, the investment bank to hand over the company's . 2007, the company acquired the BNP will take a stake in the joint venture, Changjiang BNP Paribas peregrine, as the limited liability company, the name was changed to Changjiang bnp paribas peregrine securities co., ltd., the company became a wholly owned,the first of its kind in the country specializing in investment banking subsidiary of professional

Asset Management Business

In the steady operation. Under the idea, the company continuously explored the creative business model 2001 company unveiled the silver card cooperation financing, and in 2002 became the first to launch standardized financial products; one of the 2001 company unveiled the silver card cooperation financing, and in 2002 became the first to launch standardized financial products; one of the .

In recent years, the company issued the "Yangtze River beyond financial plan," "series, due to product yields around larger - than - expected yields, the market has been formed on a certain popularity, South Americans and sustained attention to the In recent years, the company issued the "Yangtze River beyond financial plan," "series, due to product yields around larger - than - expected yields, the market has been formed on a certain popularity, South Americans and sustained attention to the . April 2005 launch of the" Yangtze River No. 1 | Surpass Wealth Management "products is the" Tentative MeasuresProcedures for Administration Assets of Clients of Securities Company Since formally implemented,the first approved issuance of only 3 aggregated financial products, and also one of the first to extract only the "risk reserve" of wealth management products (WMPs),

the end of 2006, the changjiang river beyond financial planning has issued a total of 8 million or the end of 2006, the changjiang river beyond financial planning has issued a total of 8 million or .

Fixed - Income Business

Since 1992, the company has always been a Treasury Bonds, a member of the Communist Party's national debt scale is another national brokerage ranked at the forefront of the Since 1992, the company has always been a Treasury Bonds, a member of the Communist Party's national debt scale is another national brokerage ranked at the forefront of the . since 2000, the company entered the national interbank bond market, its underwriting brokers are ranked among the Top 5, all the members of the syndicate in comprehensive performance ranks in the top 20, in consecutive years as one of the national inter - bank bond market "for non - bank excellent self - clearing members," the title of one of the few companies in the short - term financing since 2000, the company entered the national interbank bond market, its underwriting brokers are ranked among the Top 5, all the members of the syndicate in comprehensive performance ranks in the top 20, in consecutive years as one of the national inter - bank bond market "for non - bank excellent self - clearing members," the title of one of the few companies in the short - term financing .

flourished, and by 2005 only 15 underwriting short - term financing bonds, the underwriting amount of 16.05 billion yuan,In innovation - experimental companies ranked as the 4th bit company asset securitization business has also made new progress, and many enterprises has established asset securitization project development intention company asset securitization business has also made new progress, and many enterprises has established asset securitization project development intention .

Derivative Securities Business

company earlier in our warrants issued, the risk hedge theory research company earlier in our warrants issued, the risk hedge theory research . since 2005, the company's financial derivative products of the product design, hedging, arbitrage, market making, etc.) as well as the business was studied in - depth design of the generic type is completed, the upper limit and Bermuda as covered warrants, as well as products and capital - protected structured products such as ELN

In 2006, the company created the 5 only warrants, the warrant only 5, cancelled the registration of which 4 In 2006, the company created the 5 only warrants, the warrant only 5, cancelled the registration of which 4 . At present, the company is about to launch covered warrants and structured products business will be ready At present, the company is about to launch covered warrants and structured products business will be ready .

Fund Management Business

Ltd., a subsidiary of Chang Xin Asset Management Co., Ltd. has long featured Yinli, CHANGXIN INTEREST INCOME OPEN and changxin jinli trend, Changxin Income - dynamic 4 fund in accordance with the Galaxy Securities Funds Research Center published the first quarter of 2007, fund ranking, fund ranked in the top 20 three of five from Chang Xin Asset Management Corp. (

wherein changxin jinli trend, Changxin and Li Changxin silver featured at No. 3, 9 and 20 Chang Xin Asset Management Co., Ltd. is in the top 20 in only the largest fund of funds company,family owned stock funds, with all the names on the list of fund company

involving company of Fund Management Co., Ltd (Sino - America joint venture), 2006 (8 August) the process of opening an

Futures Business

Company Holdings which Futures Brokerage Co., Ltd. is active in low - cost, efficient operation of the futures business platform, fostering direct selling with cooperation period of the parallel network and marketing team, established with the customer asset appreciation as the core of the individual and the customer service system, realizing the supernormal development of the industry's fastest - growing company in recent years, the scale of the rights and interests of clients, transaction amount, etc. the main business indicators of

doubled in the first quarter of 2007, the Yangtze River in Zhengzhou Futures Exchange's total 100 billion RMB yuan, as of 9 April 2007,company in Zhengzhou in the Ranking by the Stock Exchange of Hong Kong is a 16 - bit doubled in the first quarter of 2007, the Yangtze River in Zhengzhou Futures Exchange's total 100 billion RMB yuan, as of 9 April 2007,company in Zhengzhou in the Ranking by the Stock Exchange of Hong Kong is a 16 - bit . The company currently has an upcoming financial futures business will be ready The company currently has an upcoming financial futures business will be ready .

6 6.

Company Honor

June 2, 2011, at the Shanghai gold mountain habitat would be announced 10 days in the 21 Century China Fund ", and" Chinese brokerages Award "list, won the 2010 Best China securities investor education June 2, 2011, at the Shanghai gold mountain habitat would be announced 10 days in the 21 Century China Fund ", and" Chinese brokerages Award "list, won the 2010 Best China securities investor education .